Sometimes in life we recognize that no bad news is good news. While the latest numbers in the U.S. economy and the logistics industry are middling, this comes as good news to many. The economic drop experienced over the last two quarters seems to have reversed, many industry statistics have stabilized, and much needed relief has come in the form of drops in diesel fuel prices. This is all a welcome surprise as we gear up for the holiday season.

While there remains a high level of uncertainty as far as the economy is concerned, the latest industry numbers, which are not trending downward, paint a positive picture that gives us hope for a good end to 2022 and a strong start to 2023.

Catch up on the Q2 logistics industry numbers

It’s been an up and down year for the economy, but the data does show some promising signs for the logistics industry. See how the summer went by reading our last Extra Mile Report.

Recession or not, GDP estimates predict marginal growth

Q2 GDP growth in the US was negative for the second quarter in a row in 2022, dropping by 0.6 percent and triggering debates over whether we are officially in recession territory. The negative GDP growth was led by decreases in private inventory investments, particularly in retail trade. Putting aside debates over a looming or current recession, the latest numbers point towards positive GDP growth in Q3. Economists have slowly been revising their estimates; which now predict 1.9 percent growth by the end of the third quarter.

Although inflation skyrocketed in 2022, it appears to have peaked and is now trending in a positive direction. The latest estimates put inflation at 8.26 percent (by the end of August), which is a decrease from its peak of 8.52 percent in July.

Consumer confidence and jobs are up leading into the holidays

The Conference Board Consumer Confidence Index® increased for two consecutive months (August and September) in Q3. A combination of dropping gas prices and increases in the job market has consumer confidence on the rise as we enter the holiday season. The Index now stands at 108.0 and only stands to rise in the coming months as consumers go out and spend during the holidays.

The job market also received mixed news in the form of the September jobs report. The BLS has reported in its Employment Situation that nonfarm payrolls increased 263,000 for the month. While this was short of the 275,000 estimate, it’s still positive growth for a jobs market that struggled in 2022. Unemployment has dropped to 3.5 percent. However, this number is offset by a shrinking labor force participation rate. Leisure and hospitality, health care and business and professional services led the way in jobs gains, and average hourly wages are also up 5 percent over this time last year.

Manufacturing employment also continued to trend up in September (+22,000 jobs), but the transportation and warehousing sector declined as 11,000 jobs in truck transportation were lost. However, U.S manufacturing output continues to recover in most major sectors, with only slight drops in machinery and food, beverage, and tobacco being reported.

Overall, the economic report this quarter was a mixed bag, but we can expect better growth and job creation heading into the busy retail holiday season.

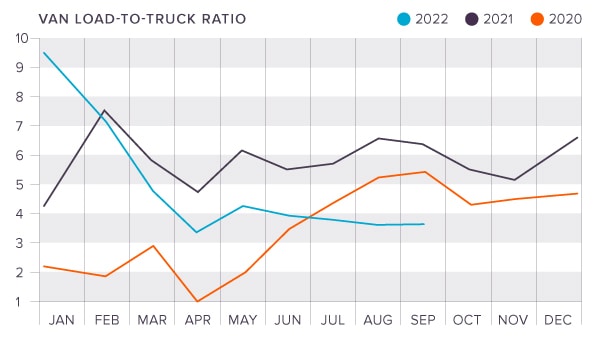

Spot rates continue to tumble

Spot rates dipped for the third quarter in a row this year, dropping to the three lowest data points of the year in July, August, and September, according to the DAT TrendlinesTM. National rate decreases indicate a decrease in freight shipments combined with an increase in capacity. An ease in port congestion is also contributing to decreased rates as ports are catching up with inbound shipments. The total number of ships waiting at all ports was down to 130 in August, a big improvement from the 150 that were reported in July. A relief in diesel fuel prices is also contributing to an ease in national freight rates.

National Spot Rates at the end of September were:

- Van: $2.64

- Flatbed: $3.06

- Reefer: $3.25

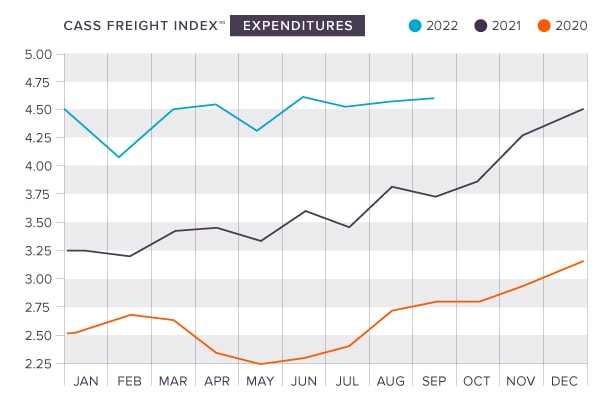

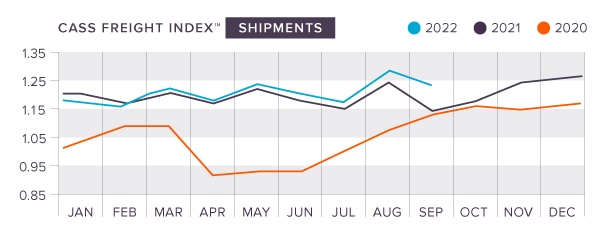

Shipments and freight expenditures follow expected trends

The Cass Indices in July and August followed expected trends late in the summer months. Total shipments rose 3.6 percent y/y in August after rising 1.9 percent in July. Total expenditures declined 3.0 percent in July and rose 1.9 percent in August. These increases were expected after a tumultuous rise and drop throughout Q1 and Q2, showing that stability has returned to the industry as we head into the holiday season. Still, there are several uncertainties in many industries that could add instability to the industry, particularly interest rate increases putting pressure on sensitive sectors like capital goods and housing. China also reversed its latest COVID-19 lockdown in June and July, which has helped retailers build seasonal inventory and ease supply chain constraints.

We remain hesitant to say that this stability will last as we head into the holidays.

Tonnage makes a quick recovery after a weak July

The ATA’s Tonnage Index made an unexpected plunge in July, dropping 1.5 percent due to softness in consumable goods, home construction, and manufacturing output. While this was the second time the index dropped in the last year, it still remains well above 2021 levels. The index recovered in August, increasing 2.8 percent after a weak July performance. We can expect more growth as we head into the holiday and consumer spending ramps up.

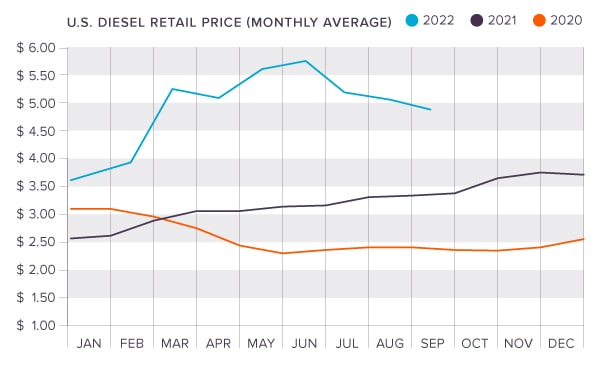

Diesel fuel prices provide much needed relief

The cost of diesel fuel is at its lowest point since February of this year, providing much needed relief to nearly every major sector. Diesel fuel prices spent almost five consecutive months over $5.00, peaking at $5.81 in June before beginning to decline. Prices dropped every week throughout Q3 and finally settled at $4.889 in the final week of September. Prices dropped in the beginning of October but are now on the rise once again.

Finish strong with King

Is your business ready for the holidays? Do you have a logistics budget and plan set for 2023? Finish the year strong and get a head start on next year with King. We are in the midst of helping our clients optimize their supply chains and create a better strategy for the new year. You can get started by having a simple conversation with us today. Get in touch with our team to discuss your shipping goals for next year.

Joel Rice

Joel Rice