The new year brought a new administration into the White House, and the start of the year has been a roller coaster ride for the economy. While stock prices are up and down by sizable margins, showing a lot of uncertainty in the markets, there remains a remarkable amount of stability in the logistics industry. While looming tariffs are projecting uncertainty for imports, all other metrics in the logistics industry are remaining relatively stable, our reporting shows.

Looking for some measure of certainty when it comes to your supply chain? See the latest numbers coming out of the logistics and trucking industries.

Catch up on the Q4 2024 Data

Want to see how the year ended? Read our Q4 2024 Logistics Industry Report.

Uncertainty in the Economy

The April U.S. Economic Forecast showed that tariff prices are having a substantial impact on both the stock market and US GDP. Markets plunged sharply before rebounding just as quickly following the announcement of delayed tariffs. As numbers swing rapidly, the only certainty in the U.S. economy is ongoing volatility.

Consumer Index Plummets; Jobs and Manufacturing Rise

US consumer sentiment plummeted to its second-lowest level on record (going back to 1952) in March. This was after decreases in January and February. Consumer sentiment plunged 11% to a preliminary reading of 50.8, the result of a trade war that broke out between the United States and countries around the world

The latest April Jobs Report brought better news despite dropping consumer confidence. In total, 228,000 nonfarm payroll jobs were added in March, higher than the average monthly gain of 158,000 over the prior 12 months. Transportation and warehousing were among the best gains, with 23,000 new jobs being added, about double the prior 12-month average gain of 12,000.

U.S. manufacturing was a mixed bag in Q1. Manufacturing output fell in January due to weak motor vehicle production. Factory output dipped 0.1% on a month-to-month basis but was still up 1.0% on a year-on-year basis. The numbers recovered in February thanks to increases in motor vehicle parts, mining output, and an overall increase of 1.6% in durable goods. Output slowed in March as tariffs loomed over factories, only increasing by 0.3% last month, but forecasts don’t show any immediate drops on the horizon.

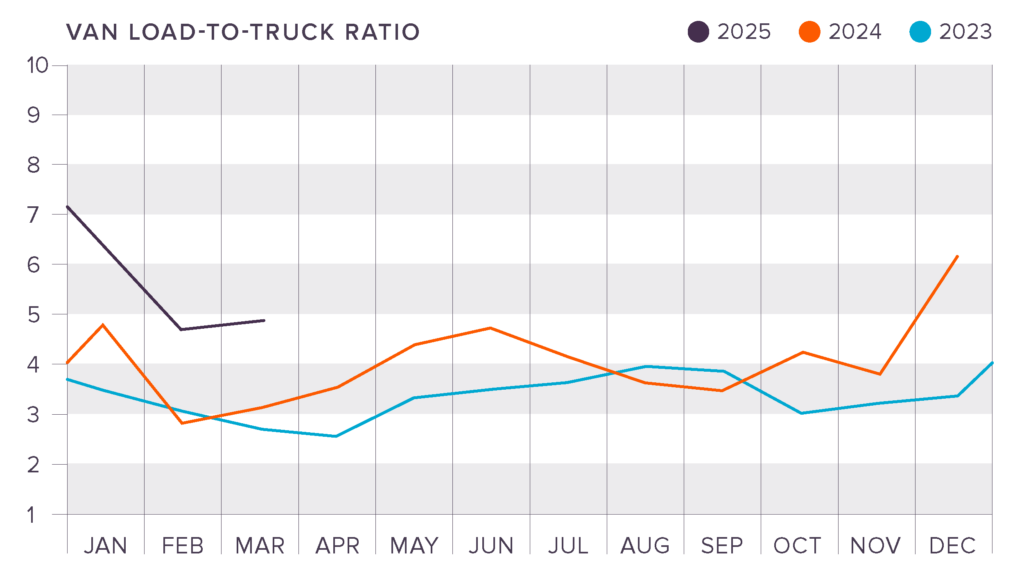

Capacity Opened High in 2025 Before Dropping

The DAT Van to Truckload Ratio opened at a high 7.18 (following recent annual trends of limited capacity in January) before rightsizing itself in February, dropping nearly 34% to 4.73. Capacity steadied in March, rising slightly to 4.82 loads per truck.

National Spot and Contract Rates at the end of March were:

- Van: $2.11 (Spot) and $2.41 (Contract)

- Flatbed: $2.39 (Spot) and $3.04 (Contract)

- Reefer: $2.48 (Spot) and $2.74 (Contract)

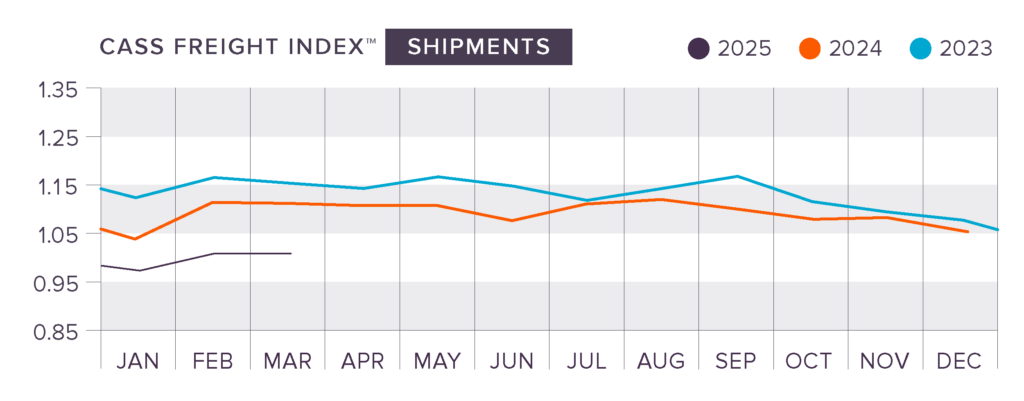

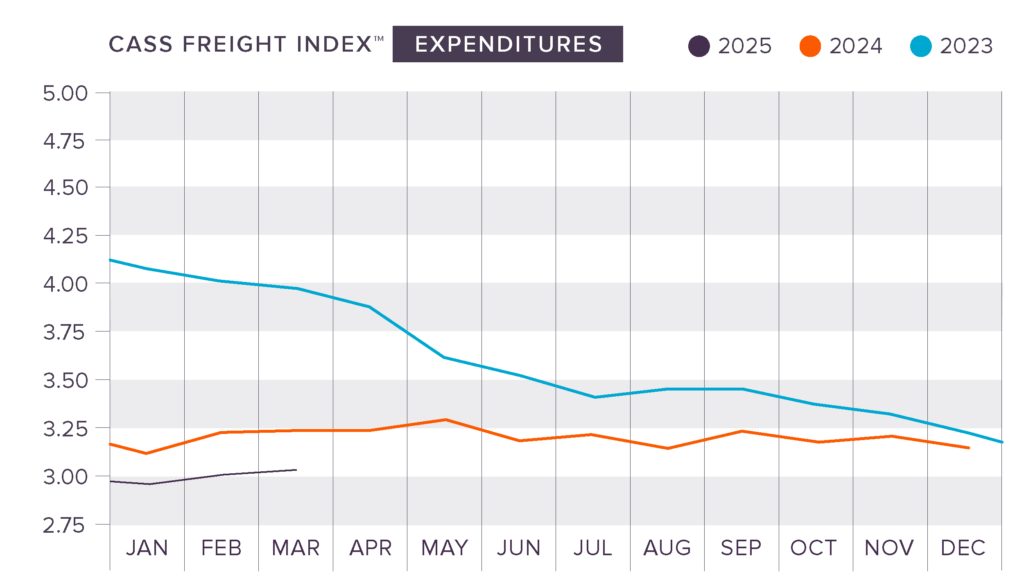

Freight Shipments and Expenditures Waver in Q1

The shipments and expenditures components of the Cass Freight Index tumbled yet again in January (dropping 5.3% m/m and 4.8% m/m, respectively), with half the decline coming from normal seasonality at the start of the year. LTL consolidation was also noted to be putting pressure on the index.

Both indexes recovered in February, with shipments increasing 7.3% and expenditures increasing 4.0%. While seasonality remained soft, the decline in the prices of goods drove freight demand during the shortest month of the year.

While the increases in February were welcomed, they were short-lived. The shipments index fell 0.2% while expenditures marginally rose 0.1% in March, showing that things were leveling off at the end of Q1.

Tonnage Surged in Q1, Hinting at a Recovery

After remaining entirely unchanged from December to January, trucking activity in the United States surged 3% in February, according to the ATA Tonnage Index, marking the largest sequential increase in several years. Gains in February were largely attributed to accelerated imports as shippers rushed to beat potential tariffs from the U.S. government.

The ATA noted growing optimism in the market, even accounting for the threat of tariffs. They noted that the first two months of the year were overwhelmingly positive, hinting that a potential freight recovery has begun. All things considered, this is great news for shippers and the trucking industry.

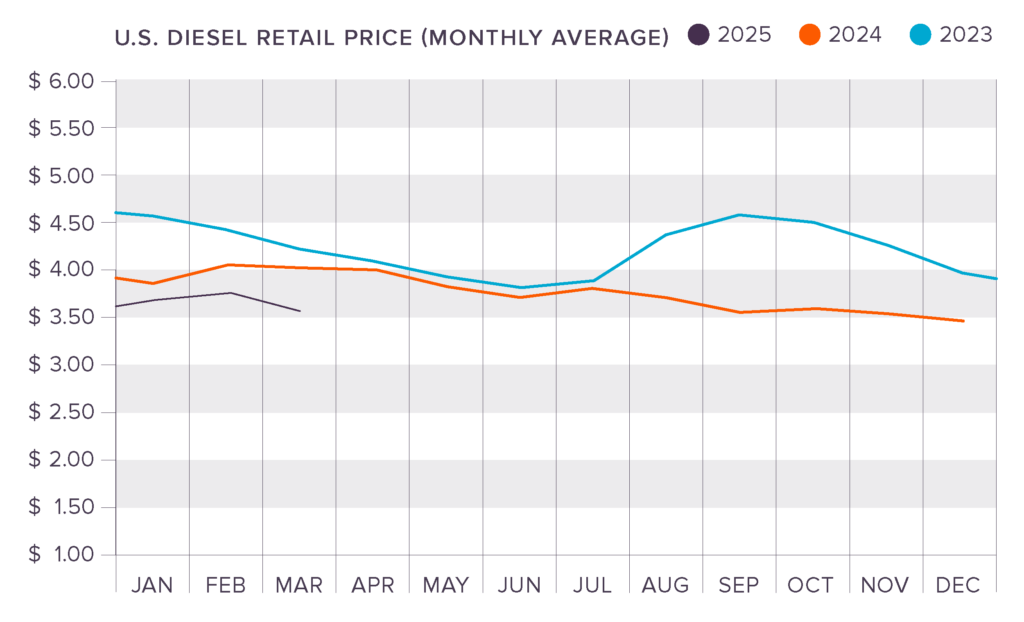

Diesel Fuel Prices Level Out

After dropping consistently for the second half of 2024, diesel fuel prices flatlined for most of Q1, starting at $3.56 in January and closing at $3.59 by the end of March. Prices have finally stabilized after years of volatility, and, despite economic uncertainty, experts are estimating that prices will drop even further as energy production increases.

Keep Momentum with King

Whether you’re looking to maintain momentum or jumpstart your supply chain, King Solutions is here to help. We’ll create a customized plan tailored to your transportation, warehousing, and e-commerce needs. Connect with us today to find the right solution for your business!

Joel Rice

Joel Rice