The logistics industry has seen its share of challenges in 2022. Rampant inflation, war, disrupted supply chains, increasing oil prices, and the lingering effects of COVID-19 have all been “the talk of the town” across the nation.

Thankfully, the numbers tell a different story. While the logistics industry is still facing significant challenges, there’s a lot of good things coming out of the data. Without further delay, let’s see what those numbers have to say.

Want to see how 2021 ended? Read our last Industry Report from Q4

The economic outlook at the start of 2022

Despite the global challenges being presented to the US economy and nearly every industry in it, the economic outlook is looking anything but grim. While GDP growth exploded in Q4 (growing by 7.0%), current predictions are estimating that it will slow to 1.7% in Q1 2022. Inflation and the war in Ukraine are also taking a toll on global markets.

That’s the worst of the news.

The US economy is going back to work, according to new forecasts. Unemployment has leveled off at 3.6%, the labor force participation rate is increasing as more people enter the workforce (US employers added 431,000 jobs in March), corporate profits are up, and Omicron’s impact has waned.

While the economy is doing better, it’s manufacturing that is lagging. The March Manufacturing PMI® registered 57.1 percent, a decrease of 1.5 percentage points from the February reading. Consumer spending has also slowed, barely rising in February and levelling off as we head into the spring months.

As people return to work, we can expect these numbers to increase as the manufacturing output of many different industries heats up.

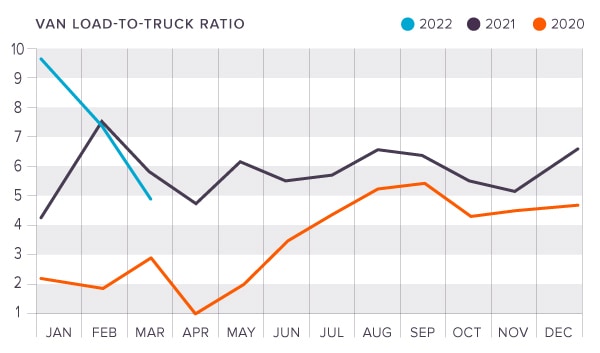

Spot rates tumble after starting at an all-time high in 2022

After starting the year at an all-time high, the DAT Van Load-to-Truck Ratio fell in February and tumbled even further in March to levels below 2021. While it’s normal for loads to increase at the end of December—as shippers look to move freight before the end of the year—the drop we have seen in Q1 of 2022 is far higher than normal, showing that manufacturing has cooled off for the time being.

We can expect to see loads increase at the beginning of Q2, particularly in the reefer sector as the domestic produce season kicks off. This could potentially impact capacity as equipment and driver numbers are still low. Fewer trucks are being built, drivers are in short supply, and there is still a low inventory of available trucks, according to DAT.

The highest van rates are being reported in the Midwest ($3.45), while the lowest are currently being reported in the Southwest ($2.80).

National Spot Rates at the end of March were:

Van: $3.03

Flatbed: $3.39

Reefer: $3.40

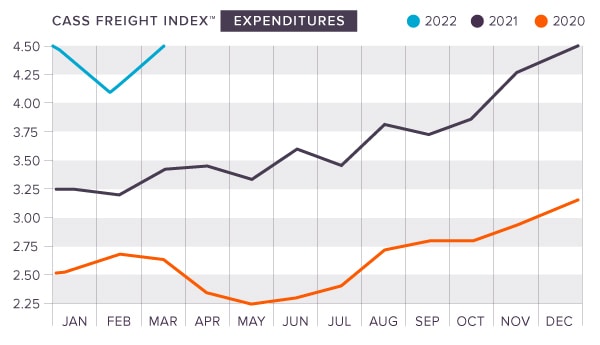

Cass Indices drop after the holidays but remain steady in Q1

Spending dropped at the start of the year as the January Cass Freight Expenditures Index fell 8.9% m/m to 4.027. This was after records were broken in December. Although there was a significant drop in January, spending was still up 31% compared to the time last year. Shipments were also down 10.8% from December and 2.9% year over year. Cass Information Systems notes that this was not a demand-driven decline as inventories are still lean and manufacturing output remains down.

The indices regained ground in February, with shipments increasing 8.6% month over month and 3.6% year over year. Expenditures were also up 10.6% month over month in this time and 42% year over year.

In March, the Shipments Index rose by 2.7%, slowing its growth as the threat of a freight recession rises on the horizon. The Freight Index also rose in March, increasing by 1.1% m/m. Freight is slowing down as more services reopen, but it’s uncertain if it will continue to impact shipments in the coming month.

Further improvements to freight and manufacturing numbers are expected to improve heading into the summer as the effects of Covid are lessened and manufacturing picks up.

The Tonnage Index stalls

The American Trucking Association’s Seasonally Adjusted Tonnage Index ticked up in January, increasing for the seventh straight time since July of 2021. The index rose 0.6% in January to 115.5, which is up 1.5% over 2021 but still off pace from its height in 2019 (before the start of the COVID-19 pandemic).

The index had increased 4.4% since July, but the gains were stalled in February as the chain of increases was broken. February was the first time in more than half a year that the Tonnage Index did not increase. While demand for trucking remains strong (despite lackluster manufacturing numbers), capacity and equipment constraints are still holding up freight numbers. Although the Tonnage Index remained flat in February, it is still up 2.4% year over year.

Supply remains an issue, rather than demand.

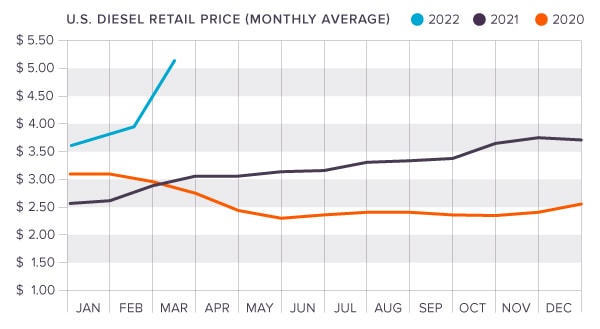

Diesel fuels prices continue their climb

After miniscule relief in December, diesel fuel prices are now higher than ever. When the Department of Energy released 50 million barrels of oil from the U.S. Strategic Petroleum Reserves in November, we saw prices drop from $3.727 in November to $3.613 in January. Come February, the increase in price continued as diesel reached $3.951 a gallon. In March, they were $5.250. As of April, prices have remained consistent, staying over $5.00 per gallon. A combination of factors continues to drive up prices, making it hard to predict just how much more they will increase in the coming months. Increased freight rates and the cost of goods, when combined with record inflation rates, are on the horizon. Shippers would do well to prepare for these increases.

Prepare for the future with King

At King Solutions, we help shippers navigate the increased rates, fuel prices, and other challenges presented by the current markets and the supply chain. We help our customers choose the right shipping methods, freight classifications, routes, carriers, and so much more, giving them everything they need to succeed in the current environment and keep their supply chain strong. The solutions are out there, let’s find them together. Get in touch with King today to talk about your current shipping challenges.

Joel Rice

Joel Rice