2020 was a year like no other. We experienced many firsts in our personal and professional lives, and the logistics industry was pushed to the brink. Shipping delays, product shortages, quarantines, and everything else COVID brought on the world created an environment unlike any we’ve seen before.

As we move further into the second quarter of 2021, some sense of normalcy has been restored, but there is much to be done to catch up. Things have stabilized (slightly), but we are still navigating an industry that is recovering from the massive shock brought by COVID-19.

Join us as we take a look back at Q1 and see how the industry is shaping up in 2021.

The economy sees signs of life

After lockdowns and quarantines plagued the entirety of 2020, the economy is set to rebound in the coming months, and we’ve already seen these signs of life in the first quarter of the year. Vaccinations, economic stimulus, and lifted restrictions are already breathing new life into a stagnated economy, and economists are predicting we will see a return to pre-pandemic highs quite soon. GDP growth in Q1 is expected to reach 3.2%, and unemployment is expected to fall as well.

The first quarter has also seen significant economic stimulus, particularly in goods. People are still spending more on products rather than services, and tax returns combined with the recent stimulus package are putting even more money into the pockets of consumers. Although the BEA noted a small drop in consumer spending in February, we expect these numbers to dramatically rise over the next few months as vaccinations continue, restrictions are lifted, and more money is delivered to people across the country.

Spot rates break records in February

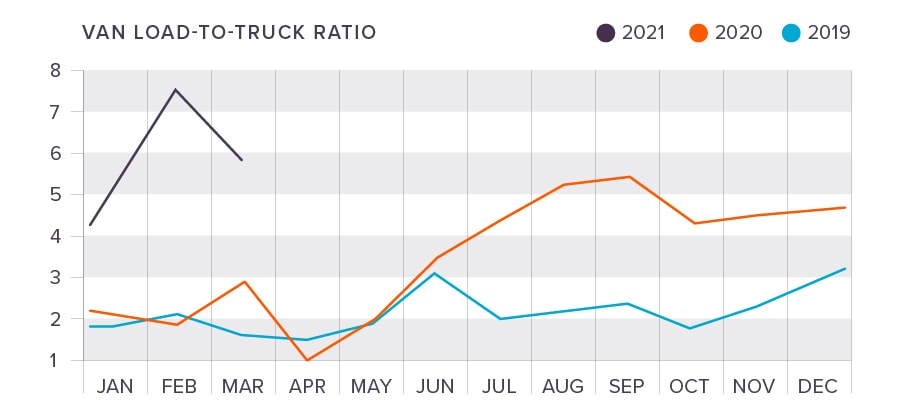

The DAT Trendlines showed a massive surge in the Van Load-to-Truck Ratio, peaking at 7.54 in February before plummeting to 5.78 in March. These numbers are well above the ratios in 2020 and 2019, with February setting record highs in Van Load-to-Truckload and Reefer Ratios. The surge was attributed to a combination of harsh winter weather and some distressed supply chains coming in after the holiday season.

National Spot Rates at the end of March were:

- Van: $2.66

- Flatbed: $2.77

- Reefer: $2.94

Although spot load posts are up about 130% YOY, tightening capacity still remains an issue for the industry. There is still a strong demand for freight carriers, as consumer spending is holding strong and focused on goods over services.

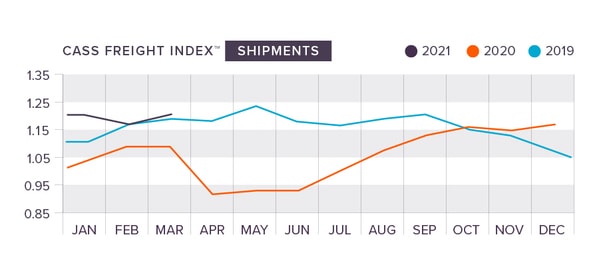

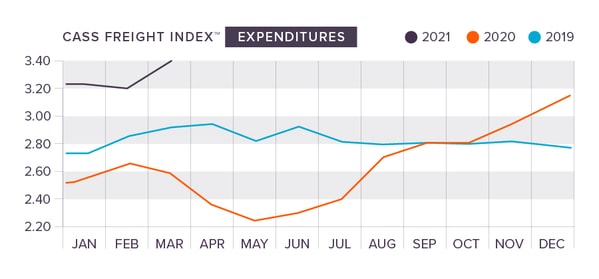

The Cass Indices drop, but the outlook is hopeful

The Cass Shipments and Expenditures Indices show growth in both shipments and expenditures over Q1 of 2020, with March posting a particularly strong acceleration in both index measurements (shipments were 10% over last year and expenditures were 27.5% over). This came after decreases in both numbers during February, showing that freight shipments are on a heavy increase moving into Q2. If these trends hold, Cass expects the Q2 number of shipments to be 20% above Q1 numbers in 2020 and 40-50% over in expenditures.

The Tonnage Index fluctuates and lags behind 2020

The seasonally adjusted Tonnage Index rose 1.4% in Janauary, but still remained 2.1% behind the 2020 number. February’s number delivered more bad news, dipping by 4.5% and coming in 5.9% below 2020. This plunge is almost completely attributed to the polar vortex experienced by the country. March performed no better, with the ATA posting a 5.1% decrease in tonnage despite an “end of quarter” rush being reported by carriers.

Despite the low performance numbers, a positive outlook is on the horizon. With economic stimulus packages being delivered to consumers, on top of possible tax returns and increases in vaccination numbers, tonnage is expected to increase in Q2.

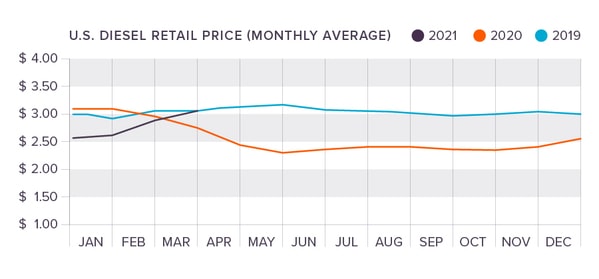

Diesel fuel prices continue their climb

After reaching lows we haven’t seen in years in 2020, diesel fuel prices have begun to climb once again. January started the year off at 2.640 per gallon, with increases to 2.738 and 3.072 coming February and March, respectively. April’s numbers are already in, and the increases show no signs of stopping. As we push into summer, shippers and carriers can expect diesel fuel prices to climb even higher, possibly reaching numbers we haven’t seen in several years.

Spring forward with King

While the effects of COVID may be tampering down, we are still entering uncharted territory. This year, we will hopefully see a (somewhat) return to normal, but many uncertainties still remain. As always, King Solutions is here to help you navigate whatever may come. Get ready for a recovery and prepare for the future with us today.

Joel Rice

Joel Rice