We’ve reached the halfway point of the year. Based on the numbers from our last report, we determined that there was plenty of room for growth in both the economy and the logistics industry. While that growth has yet to manifest itself, the industry is at a stable point. Stability is the name of the game this quarter, and all companies need to do is continue to weather the storm as we push into better economic times.

Find Out What Happened at the Start of 2023

Want to see how 2023 started? See the data from our Q1 Report.

GDP Growth Looks to Slow in the Coming Months

While the country continues to stave off a recession, the economic outlook for the remainder of 2023 points to coming challenges. Persistent inflation, rising interest rates, uncertainty over the federal debt ceiling, and many other factors have caused economists to revise their outlook—they now predict a slowing of GDP growth to 1.3 percent in 2023 and 0.1 percent in 2024. Consumer spending is flat and unlikely to increase as student loan payments resume in September, and decreased government spending has also put a damper on economic growth.

Despite the outlook, there is some good news. The latest report on inflation is far better than predicted. June’s inflation figures were only 3.0 percent higher than last year’s. Prices are coming down in most sectors, and even gas prices have tumbled from recent highs.

Consumer Confidence Soars as Employment and Manufacturing Output Remain Level

The U.S. Consumer Confidence® had substantial increases in June, reaching its highest level since January 2022. The index rose sharply to 109.7, up from 102.5 in May. This reflects the stable employment situation in the U.S. and is further driven by expected declines in inflation rates. While consumer expectations are high, shining a good light on the market, there is still the ever-looming chance of recession on the horizon.

The June Employment Situation noted that nonfarm payroll employment increased by 209,000 throughout the month. The unemployment rate (3.6), number of unemployed people (6.0 million), and labor force participation rate (62.6) were unchanged in June. While there were losses in the number of transportation and warehousing jobs (down 7,000), the numbers are only a slight loss in the overall picture of employment in the U.S.

U.S. manufacturing output continued to limp along in Q2, hovering between 0.2 and 0.4 percent as the country struggled to produce goods in many industries. Output remains low, and there hasn’t been a significant rate of imports to fill the gap, either.

Van Demand Increases Slightly, but Capacity Remains in a Good Place

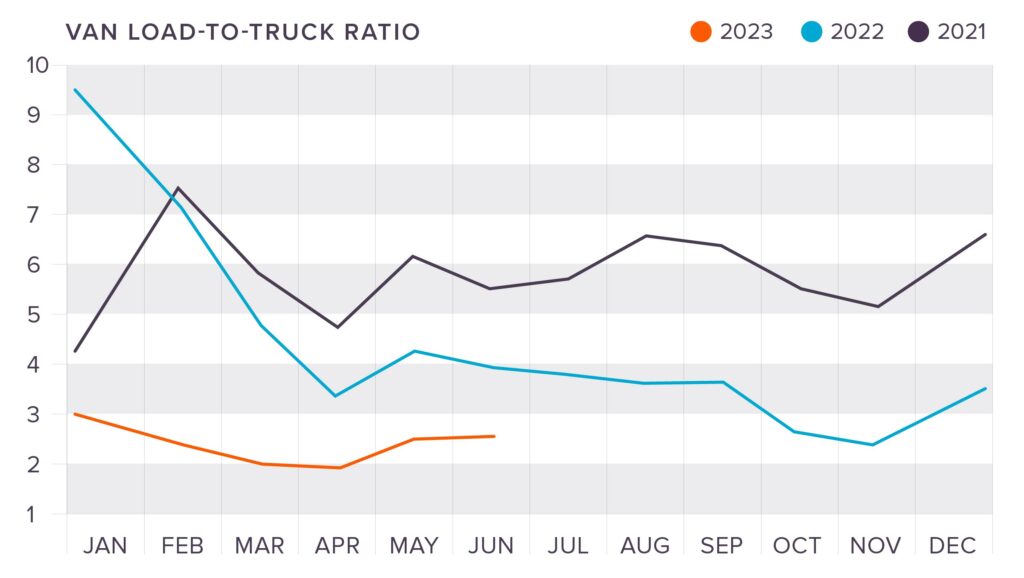

After dipping to the lowest point of the year in April (1.9), The DAT National Van-to-Truckload Ratio recovered throughout Q2, increasing to 2.5 in May and 2.59 in June. Ratios still lag significantly behind 2022 and 2023 numbers, indicating that demand is still relatively low from shippers. Rates are stable, and carriers are available, which puts the market in a good place in terms of capacity this summer.

National Spot and Contract Rates at the end of June were:

- Van: $2.08 (Spot) and $2.56 (Contract)

- Flatbed: $2.60 (Spot) and $3.16 (Contract)

- Reefer: $2.47 (Spot) and $2.85 (Contract)

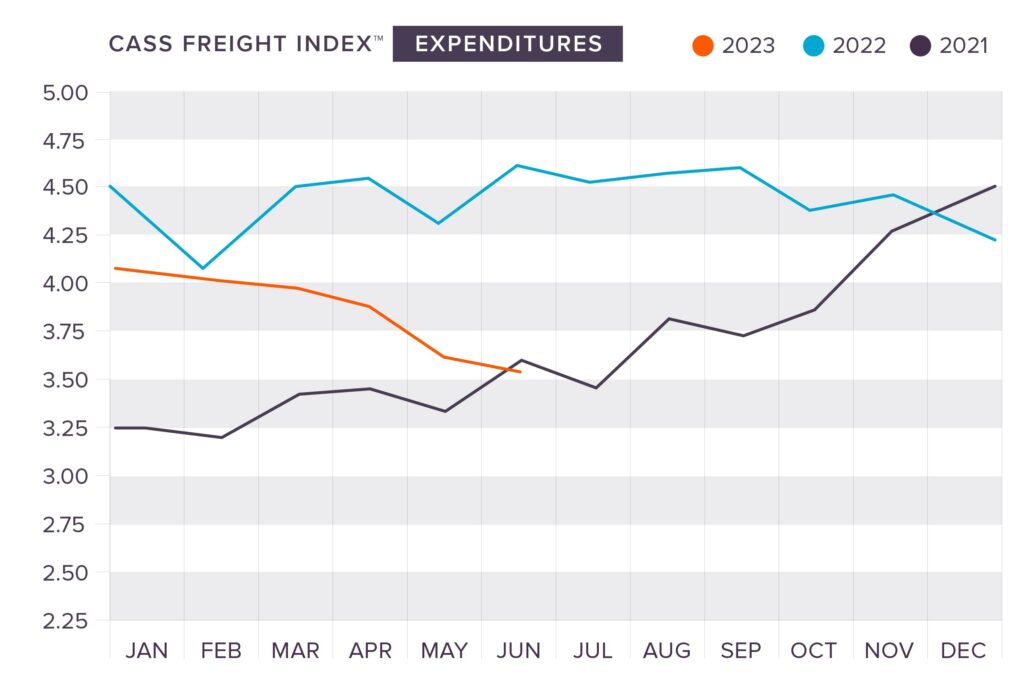

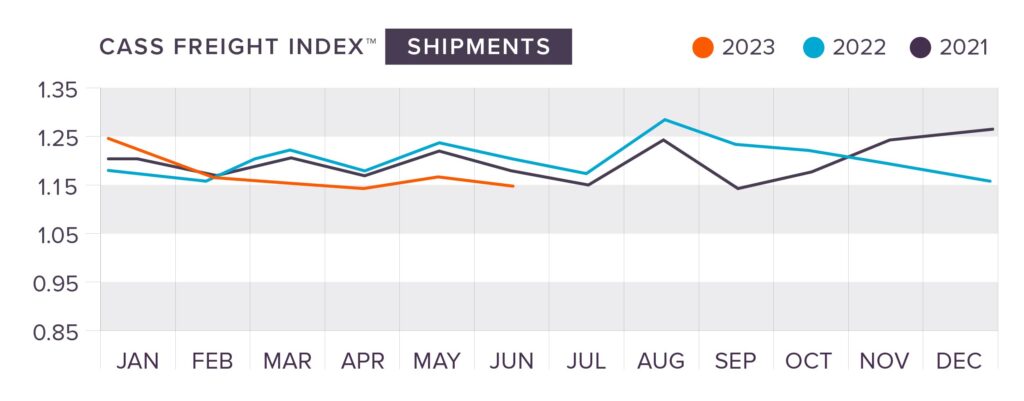

Cass Freight Indexes Show that Freight is in Decline

Numerous drops in both the Cass Shipments and Expenditures Indexes continue to demonstrate that freight is dropping as we move through the summer months. Both the Freight and Shipments Indexes dropped in April, decreasing by a seasonally adjusted 1.3 percent and 4.0 percent m/m, respectively. This was a 14 percent drop in the y/y number in 2022. The declines continued in May, with the Shipments Index dropping 0.8 percent and the Expenditures Index declining 7.8 percent. In June, the Shipments Index fell 1.9 percent and the Expenditures Index dropped 2.8 percent.

The softening of freight shipments and expenditures are largely due to declining retail sales and ongoing destocking issues that have persisted throughout the year. While it seems like we are seeing a consistent downward trend, it’s likely that the worst is behind us for the year as incomes improve and businesses prepare for the holiday season.

Tonnage Remains in Recession

April was soft for freight activity, with the American Trucking Associations Tonnage Index slipping 3.4 percent (to 112.7) when compared to the same time in 2022. This drop was the largest y/y decrease we’ve seen since February of 2021. This is the second y/y decrease in two months, indicating that the goods economy is softening, and truck freight is falling. The index also dropped by 1.7 percent when compared to March despite an economy that is on the rise.

While the Tonnage Index increased in May, rising 2.4 percent (to 115.4) to recover some of the lost ground in April, there are still concerns of a freight recession lingering on the minds of some logistics experts and economists. The slowness in the housing market (due to rising interest rates) has led to a significant decrease in the shipment of appliances, furniture, and construction materials, and there’s still a lot of uncertainty about the willingness of consumers to make big ticket purchases that will help bring balance to the freight market.

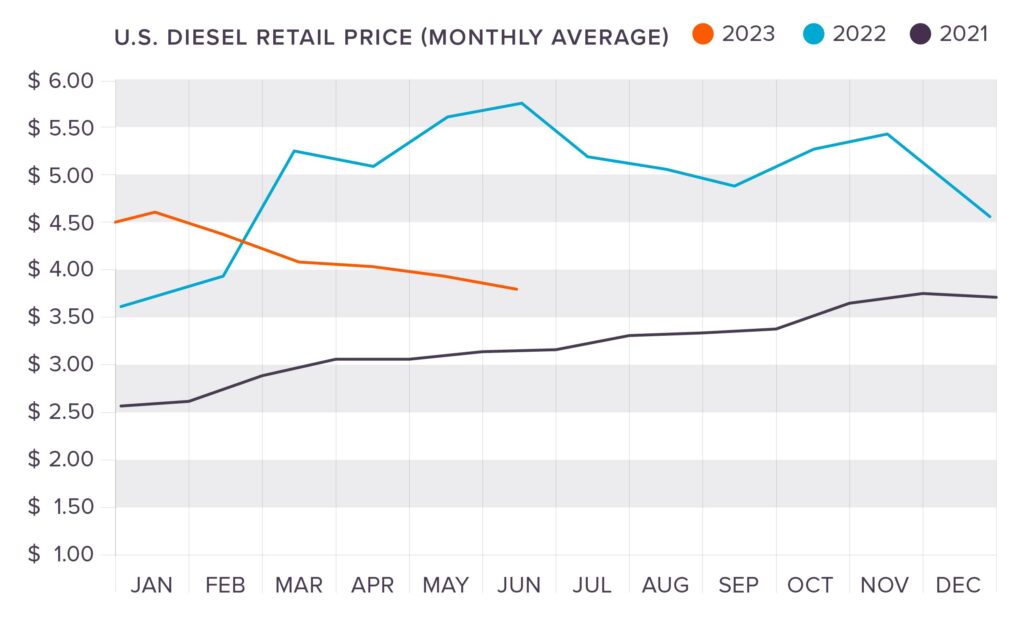

Diesel Fuel Prices Hit a 13-Month Low

Diesel Fuel Prices continued to drop all throughout Q2, providing much needed relief for the industry and hitting a 13-month low. Prices are now at levels that we haven’t seen since January 2022. Prices have leveled off a bit as we look at the current July numbers, but there are no signs that they will creep back up as we hit the back half of the summer.

Diesel fuel prices were at their lowest point on May 29th, dropping down to $3.85 per gallon. As of the writing of this report, they dropped even lower to about $3.83.

Prepare for Peak Season with King Solutions

We are almost in peak shipping season! Before you know it, the holidays will be here. It’s this time of year that you need to make sure your docks are clear of congestion, your fulfillment process is in ship shape, your routes are well planned, and your supply chain is ready to go.

Are you prepared? Are you feeling as efficient as you can be? If you have any doubts about the performance of your supply chain this peak season, or you just want to talk about your strategy for next year, get in touch with our logistics experts today to talk about your needs!

Joel Rice

Joel Rice