We’re already halfway through the year. How’s the economy and the logistics industry looking? While the first quarter of the year showed that the economy remained stable. In Q2, that stability remained, but we’re expecting better growth in the coming months. There’s mixed news in the current data, but the important metrics (inflation, GDP growth, jobs, and diesel fuel prices) are all headed in the right direction.

Is the worst behind us in the economic recovery? Find out the latest news and see the latest figures in our industry report.

Catch up on the Q1, 2024 Data

Want to see how the year started? Read our Q1 2024 Logistics Industry Report.

Expected Economic Growth is Near

The latest projections put GDP growth at 2.7 percent, a near doubling of the real GDP growth rate of 1.4% in Q1. GDP growth is expected to continue rising later in the year as inflation cools and interest rates are pulled by the U.S. Central Bank.

Consumer Confidence Wanes Despite Slowing Inflation and Job Gains

Optimism in the economy took a hit in Q2, with the Consumer Confidence Index falling to the lowest point it’s been since the end of 2023. Surveys indicated that consumer optimism declined, particularly in non-essential goods. This was largely due to the concern about rising prices. Inflation is still pushing prices up to multi-year highs, but the increases softened in Q2. Inflation fell by 0.1% in June, its lowest monthly growth rate since May 2020. Despite the drop m/m, inflation is still up from last year.

The U.S. Employment Situation Report in June revealed more increases and job gains. In total, nonfarm payroll employment increased by 206,000 and the unemployment rate was unchanged at 4.1%. While overall job gains were strong, there was little change in the total number of manufacturing, wholesale trade, and transportation jobs.

Manufacturing output also struggled in Q2, marginally increasing 0.4% in April while sharply decreasing by 2.7% in May. Output leveled out in June, with a small increase of 0.4%, but its large decrease in May still leaves the total Q2 output lagging. There is optimism on the horizon as the U.S. Central Bank is expected to pull back on interest rates to stimulate the economy later in the year.

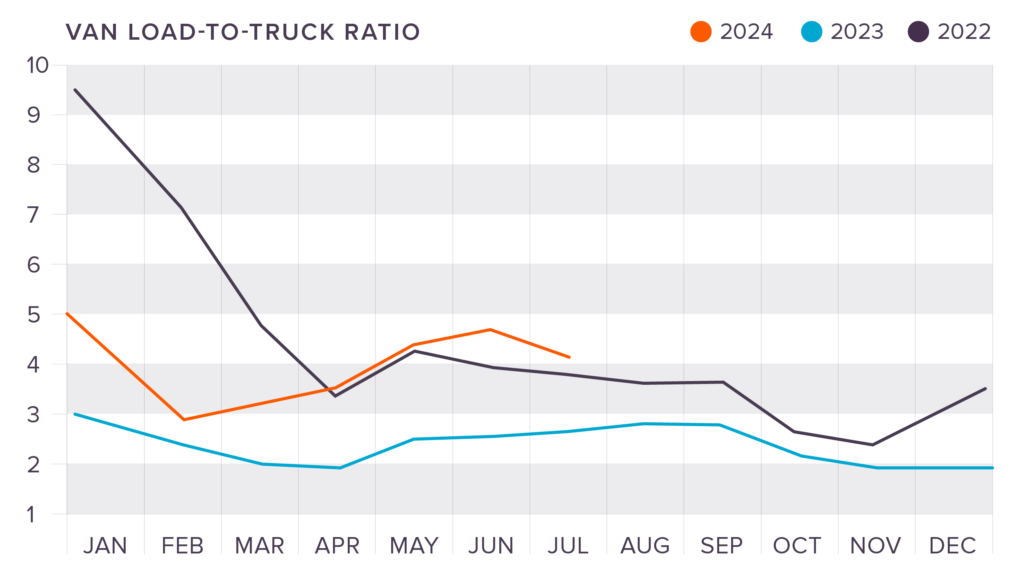

Capacity Tightened for Vans and Flatbed

Van and reefer capacity tightened throughout Q2, with only reefer capacity increasing over the last three months. The DAT Van Load-to-Truck Ratio heavily increased from 3.13 in March to 4.72 in June. Reefer capacity also saw strong increases from 4.83 in March to 7.03 in June. Only flatbed capacity remained relatively flat in April and increased in May and June, with the ratio of loads per truck dropping to 14.65 by the end of the quarter.

National Spot and Contract Rates at the end of June were:

- Van: $2.06 (Spot) and $2.41 (Contract)

- Flatbed: $2.51 (Spot) and $3.02 (Contract)

- Reefer: $2.44 (Spot) and $2.78 (Contract)

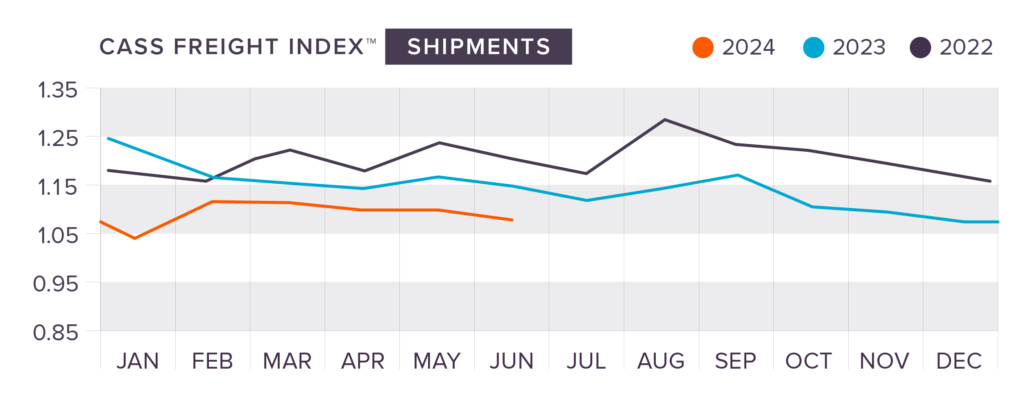

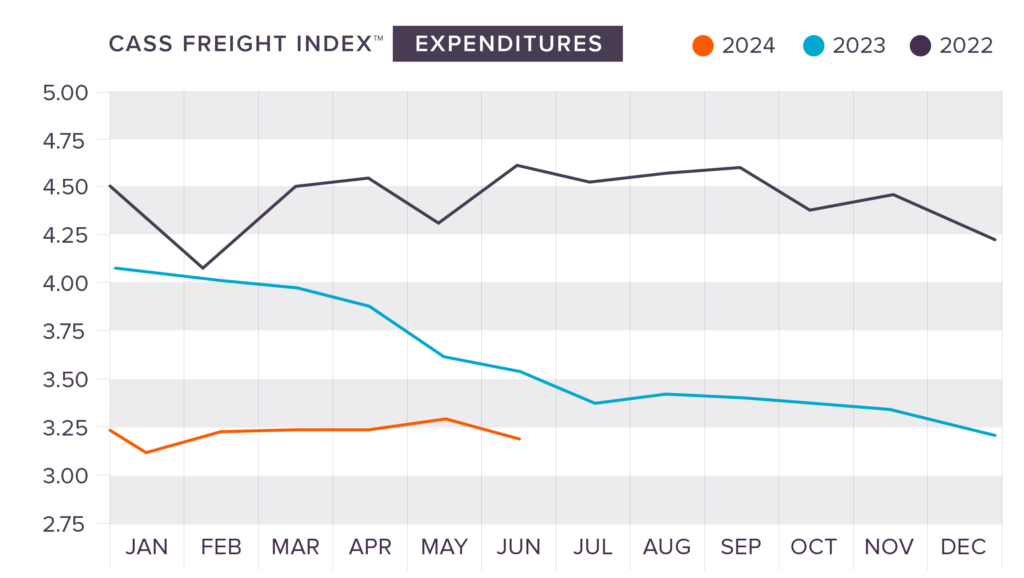

Freight Expenditures and Shipments Level Out in Q2

The Cass Freight Index® for shipments and expenditures wavered throughout Q2, with decreases and increases throughout each month resulting in a flat Q2 that remained relatively unchanged from Q1.

In April, the Freight Index fell 1.6% m/m while expenditures fell 1.9% m/m. In May, the shipments index fell even more sharply, decreasing by 3.1% m/m while expenditures rose 1.9% m/m. Freight shipments fell again in June, decreasing by 1.8% m/m while expenditures dropped by 3.2% m/m.

Most of the month-over-month changes are in line with seasonal trends from years past, and there is no indication that there will be major changes in trends in the upcoming months.

Tonnage Remains Uncertain

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index remained soft in April, declining 1.2% after also dropping 2.2% in March. Freight remained soft until the Memorial Day weekend in May, which heavily contributed to a 3.6% increase in the Index that month. This increase was the first year-over-year and month-over-month rise in tonnage this year. While the news is welcomed in the industry, it is uncertain if the freight market will continue to grow in the future months or if this increase in tonnage was only the result of a busy holiday weekend.

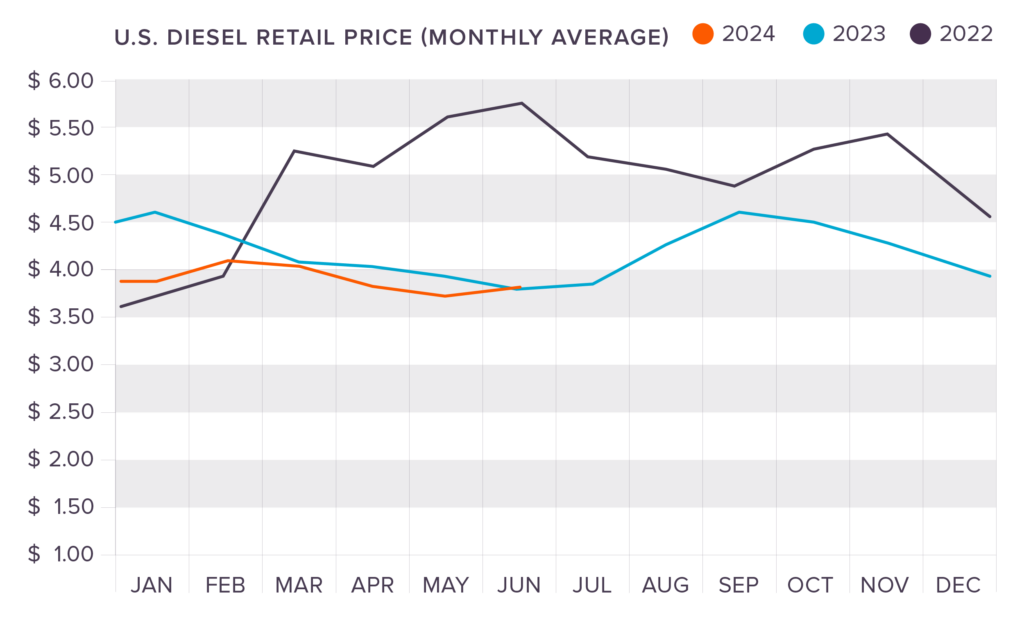

Diesel Fuel Prices Continue to Decline

Diesel fuel prices continued to trend in the right direction throughout Q2, declining from $3.996 per gallon at the beginning of April to $3.769 by the end of June. As we push into the latter half of the year, prices have remained relatively stagnant in July. However, they are still down from this time last year, and their decreases continue to lift some of the pressure off freight rates and provide some relief for shippers.

As of the writing of this report, diesel fuel prices are at 3.768 per gallon.

It’s Not Too Late to Make a Change This Year

We may be pushing into the latter half of the year, but it’s not too late to change your logistics strategy for the better! The holidays are closer than you think, and planning should start now. Get ahead on one of the busiest shipping times of the year by creating a custom plan with King! Ready to talk about how you can ship more effectively? Get in touch with us today!

Call 800.728.8632.

Joel Rice

Joel Rice