As we move into Q3 and the back half of the year, there are a lot of changes in store in terms of the economic outlook and trends in the logistics sector. The passing of the One Big Beautiful Bill Act (OBBBA), threats of tariffs, and other changes are casting a lot of uncertainty on the horizon, but the numbers are showing that the industry is stable at the moment. There is remarkable resilience in the labor market, increases in manufacturing output, and costs—from freight to fuel prices—have remained relatively stable.

There is nothing overly concerning in the near future, but more changes are coming as new trade deals are struck with overseas partners. In the meantime, see how Q2 fared for this year and what you can predict for the remainder of 2025.

Catch up on the Q1 2025 Data

Want to see how the year started? Read our Q1 2025 Logistics Industry Report.

The Economy Recovered in Q2

After a shocking drop in GDP in Q1 2025 (0.5%), Q2’s growth increased by 2.8%. Further (but smaller) increases are expected to come in future quarters.

Consumer Index Drops While Manufacturing Output Increases

US consumer sentiment had an up and down quarter, skyrocketing in May before losing half of those gains by the end of June. The Conference Board’s Consumer Confidence Index® wound up at 93.0, marking its sixth monthly decline in the past seven months. This also marks the second lowest level the index has been at in over four years as consumers reduce their spending.

The U.S. Employment Situation remained relatively unchanged in June, with total nonfarm payroll employment increasing by 147,000 in June and unemployment remaining at 4.1%. The labor force participation rate also changed little at 62.3% in June, and the employment-population ratio held at 59.7%. Jobs in construction, manufacturing, wholesale trade, retail trade, transportation and warehousing remained stable, capping an unremarkable quarter for the labor market.

U.S. factory production had a very good story to tell in Q2, increasing more than expected as U.S. factories output more goods into the market. Output increased by 0.3% in June alone, double what experts predicted. This was after another 0.3% increase in May. Production at factories increased 0.8% on a year-over-year basis in June and grew at a 2.1% annualized rate in the second quarter.

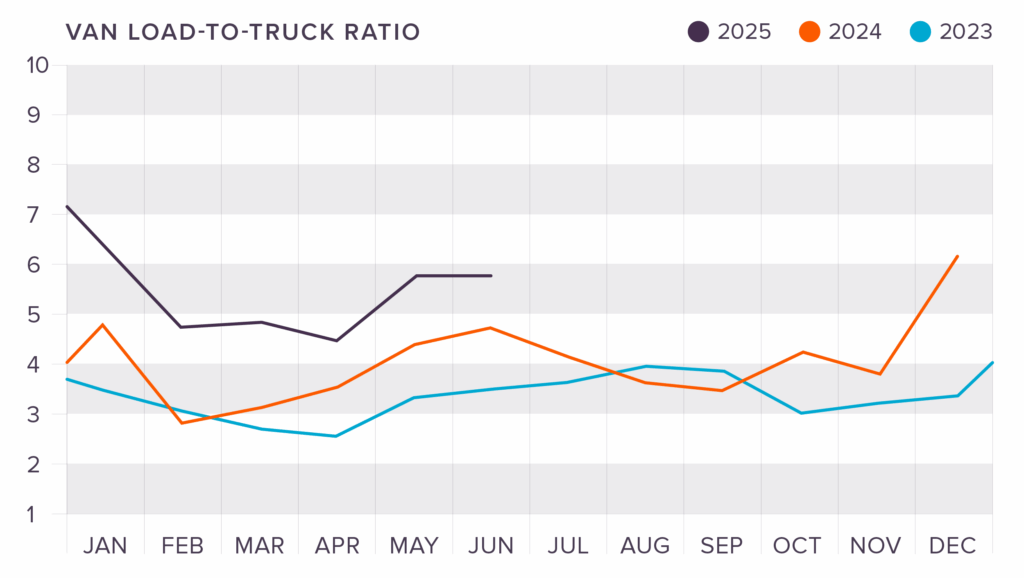

Capacity Tightens as Tariffs Loom

After capacity heavily increased to start the year, the DAT Van Load to Truck Ratio began to tighten in Q2, increasing by 1.3 points after hitting a peak in capacity in April. Capacity heavily decreased before leveling off in June, landing at a rate of 5.79 loads per truck. This capacity crunch was largely due to companies pulling forward imports early on in the quarter to avoid potential tariffs.

National Spot and Contract Rates at the end of June were:

- Van: $2.02 (Spot) and $2.41 (Contract)

- Flatbed: $2.57 (Spot) and $3.08 (Contract)

- Reefer: $2.37 (Spot) and $2.74 (Contract)

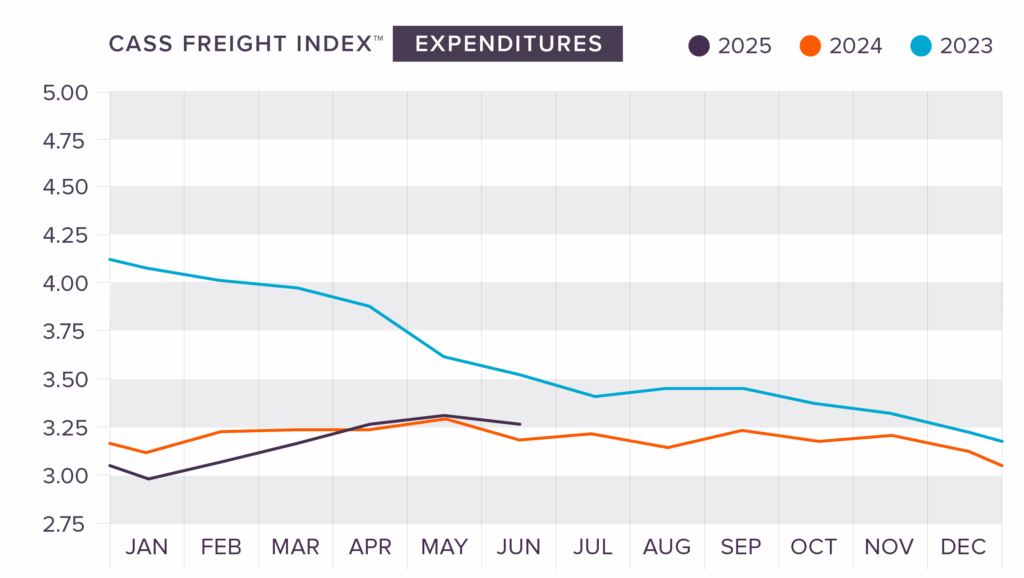

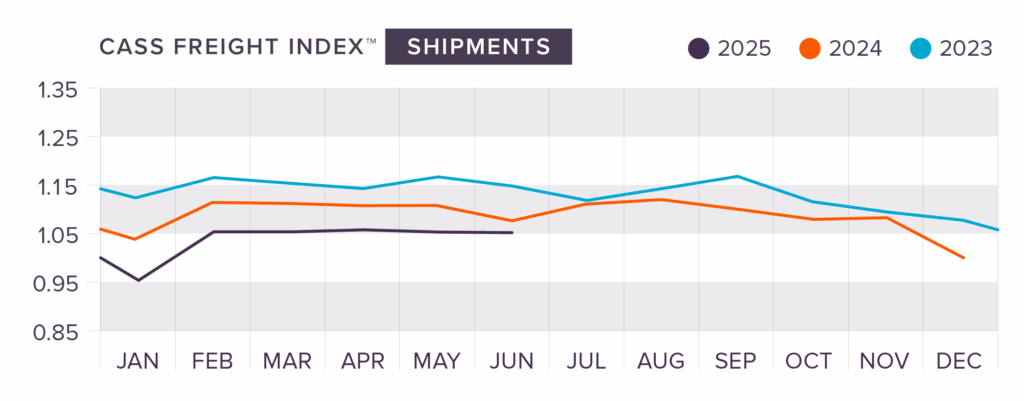

Freight Shipments Level Off as Expenditures Rise

Freight shipments remained level in Q2, slightly rising 0.4% m/m in April while dropping the same amount in May. While shipments remained level, expenditures increased significantly (3.3% m/m in April and 1.4% m/m in May). These increases, combined with stagnant shipment levels were explained by higher freight rates, with the average cost of a shipment rising by 5.0% y/y in May. Full truckloads were higher than normal in Q2 as LTL shipments brought in lower numbers than expected. The looming “trade war” and tariffs were also blamed as international volumes remained soft in Q2, but Cass Information Systems predicts that this trend will reverse itself in Q3 due to recent deals struck between China and the United States. While U.S. consumers are still largely buying pre-tariff goods, retailers will begin to run out of these as we head later into the year.

Tonnage Slips as Trucking Activity Remains Soft

Following a few months of softness in the Q1 freight market, the seasonally adjusted tonnage index from the American Trucking Association (ATA) fell again for two consecutive months in Q2. Truck freight tonnage decreased 0.3% in April after contracting 1.5% in March, and the index fell again by 0.1% in May. The ATA was quoted as saying, “Unfortunately, a recovery that was expected this year hasn’t transpired as the industry deals with a freight market in flux from tariffs and softening economic indicators.” Manufacturing output and construction activity were also blamed for the soft freight market, and the ATA is finding it hard to discern patterns as we head into the latter half of the year.

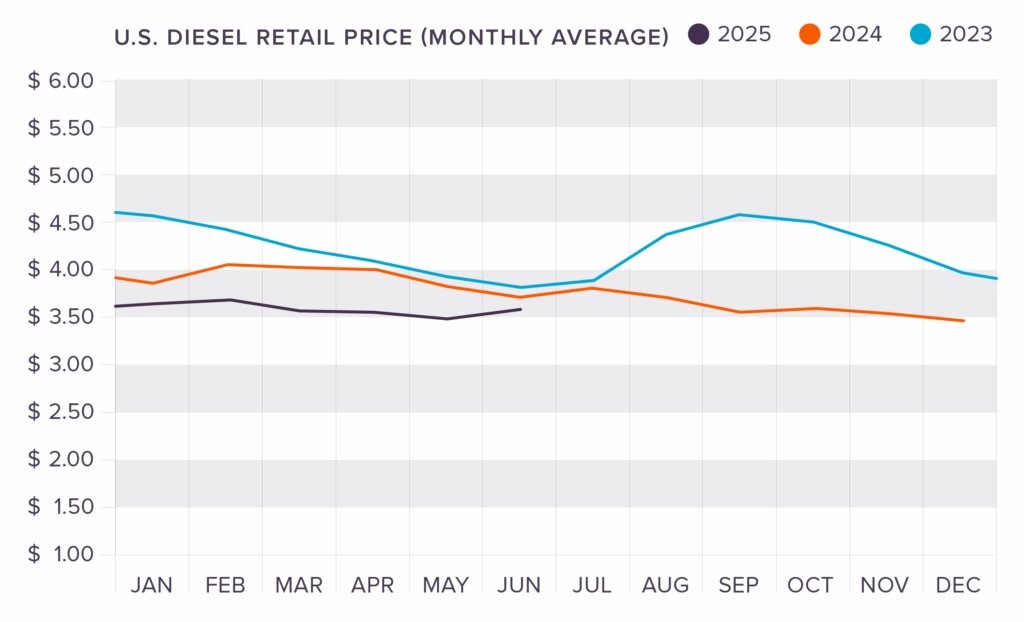

Diesel Fuel Prices Begin to Rise, Slightly

Following the trend from earlier months in 2025, diesel fuel prices gently fluctuated, changing no more than nine cents up or down throughout Q2. May saw the low point for prices so far in 2025, dropping to $3.476 around mid-month. From there, diesel prices ticked upward to $3.727 by the end of June.

As of the writing of this report, diesel fuel prices have increased further to $3.758. If recent years are any indication, prices will continue to rise as the demand for diesel increases going into the cooler months of the year. Experts estimate that prices will steadily increase in the coming months.

Are You Ready for the Back Half of the Year?

Most businesses just try to coast into the back half of the year, holding steady on their strategic plans for their supply chain and logistics department. At King Solutions, we say it is never too late in the year to begin a new plan. We help businesses transform their supply chain and create a better way to store and ship their freight.

The holidays are closer than you think. Is your business ready for increased sales? Call us today to find the best solution for your business.

Joel Rice

Joel Rice