This has not been an easy year for the U.S. economy, but it, like the logistics industry, is resilient. We’ve seen inflation rise, manufacturing output falter, and GDP growth fall into near recession territory, yet supply chains keep moving. We’ve seen consumer confidence falter and retail foot traffic fall, yet job growth in the transportation sector grows. We’ve seen diesel fuel prices increase, yet businesses keep on moving shipments in efficient and affordable ways.

What’s in store for 2024? We can’t say yet, but the latest numbers from the economy and the logistics industry paint a detailed picture of what’s happening here and now. See what’s in store for the rest of the year in our latest economic report.

See What Happened in During the Summer Months

Need to catch up? Read our Q2 2023 Logistics Industry Report.

The Economy Shows Resilience

Despite predictions of a slowing economy late in 2023, the U.S. economy showed some resilience in Q3, and experts predict that GDP growth will remain stable in the coming months. Both Q1 and Q2 of 2023 showed 2.1% GDP Growth, but a looming government shutdown and a major auto worker strike are threatening to make the last quarter of 2023 a struggle for the economy. Inflation has slowed to 3.7%, but it has been on the rise since its low in June and is also still outpacing GDP growth.

The economy may not be the strongest at the moment, but it has shown some resilience in the face of some of the challenges we have faced in 2023.

Consumer Confidence Cools as Employment Soars

After heavy increases in Q2, the U.S. Consumer Confidence® reached its highest level of the year in July, rising to 117.0 and spelling good news for the economy. Since then, the index has dropped for two consecutive months (dropping to 106.1 in August and 103.0 in September). As interest rates climb, spending confidence can decrease.

Although the early summer gains were erased in Q3, a hot labor market should reverse this trend in Q4. The latest BLS Jobs Report for September showed a vigorous increase in job creation, with more than 336,000 non-farm payroll jobs being added. Job creation was largely spread out among leisure and hospitality, government, and healthcare, but 9,000 truck transportation jobs were also added, cutting into a heavy 25,000 loss of jobs the industry experienced in August.

U.S. manufacturing output is now in its seventh month of straight y/y decreases, continuing the trends of low production and inventory for products in retail stores. Manufacturing output decreased 0.65% in July, 0.94% in August, and 0.83% in September, with no signs of increases in the near future. It’s likely that production and output will remain on the decline through the end of the year.

Capacity Remains Stable and Higher than Previous Years

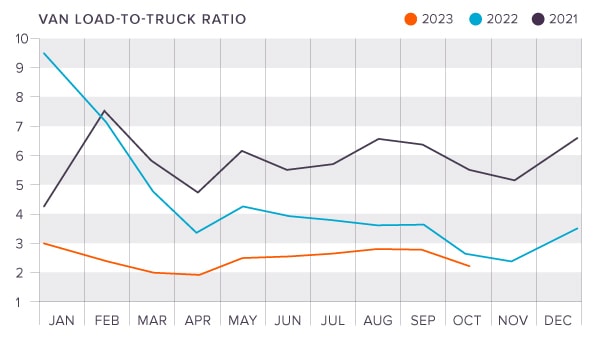

Van, Flatbed, and Reefer capacity continued to stabilize, remaining fairly unchanged throughout Q3. The DAT Van Load-to-Truck Ratio is trending upward, the Flatbed Ratio is static, and the Reefer Ratios are trending downward. In all, there is not much to say about capacity across the board; it remains fairly unchanged from the Q2 numbers. If trends follow prior years, we can expect capacity to tighten as the holidays approach.

National Spot and Contract Rates at the end of September were:

- Van: $2.11 (Spot) and $2.61 (Contract)

- Flatbed: $2.50 (Spot) and $3.17 (Contract)

- Reefer: $2.47 (Spot) and $2.95 (Contract)

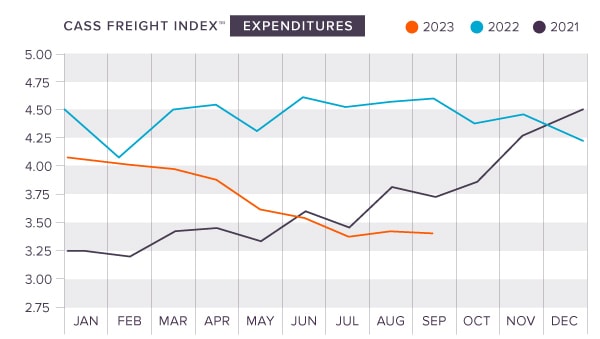

Destocking Continues to Impact the Freight and Shipments

Shipments continued to decline in Q2, with the July Cass Shipments® Index showing a 2.2% m/m decrease and an 8.9% y/y decrease. July freight spending also decreased, with the Cass Expenditures Index® showing a 2.8% m/m decrease and a 24.4% y/y decrease. While destocking continues to be an issue for freight, with declining retail sales also contributing to the lower numbers, shipments and expenditures are on the rise. The Cass Shipments Index rose 1.9% m/m in August, with an accompanied 1.1% m/m in the Cass Expenditures Index.

As the holiday season jumps into action, we can expect shipments and expenditures to increase throughout the end of the year. The real indicator for significant increases or decreases will be tied to projected GDP growth and the trajectory of the economy in 2024.

Tonnage Recovers After Hitting Rock Bottom

As we noted in our last report, freight activity was soft in April, hitting what the American Trucking Association (ATA) described as “bottom” for tonnage in the U.S. There was a decent recovery in May, which was followed up by further increases in July and August. The Seasonally Adjusted (SA) Tonnage Index ticked up 1.1% in July and 0.2% in August, reaching 115.3 by the end of the month.

The increases are good news, but they still lag the August numbers from last year. While year-over-year comparisons are difficult because tonnage peaked in September of 2022, the numbers are still trending upward. There are some headwinds to overcome, specifically when it comes to decreased factory output, but we should expect to see further increases throughout the holiday season.

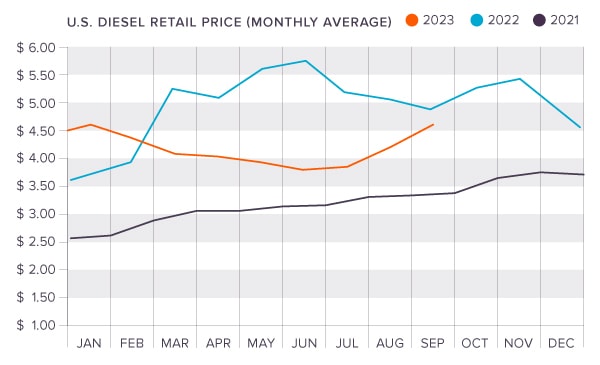

Diesel Fuel Prices are Stable and Trending Down

Diesel fuel prices had a major increase in July and early August, jumping from a near low of $3.767 per gallon to over $4.50 a gallon. Prices were stable throughout August and September—hovering between $4.30 and $4.63—before starting to trend down into October. If trends follow the previous years, we can expect fuel prices to drop towards the end of the year and into the holiday season. Prices tend to be stable this time of year, slowly dropping as we push into winter.

As of the writing of this report, diesel fuel prices are $4.444 a gallon.

What’s Your Logistics Plan for Next Year?

Your supply chain and logistics strategy are never perfect, there’s always room for improvement. Now is the time to plan what you want to accomplish next year:

- Are you looking for more efficiency?

- Are there places where you can cut costs?

- Do you have KPIs that you want to improve?

These are only a few issues customers have when they come to King Solutions. Our team can help you review your supply chain and identify where you can improve. We don’t stop there. We’ll also build you a customized logistics strategy that will help you meet your goals in 2024. Whether you’re struggling with strategy or execution, you can trust our team to bring the solutions. Contact us today for a quick consultation!

Joel Rice

Joel Rice