As Q3 wraps up and summer ends, a few things are unavoidable: the days will become shorter, the weather will become colder, and the shipping industry will be at its busiest. The holiday season is fast approaching, and to help you avoid some unnecessary logistics headaches, we’re bringing you the latest numbers, insights and industry trends.

As a recap, read our Q1 logistics industry update and our Q2 logistics industry update.

Here’s what’s happening in the industry:

‘Tis the season for booming economic growth

All economic indicators are currently pointing towards a strong holiday season. GDP growth is increasing as the year continues – Q1 growth was 2.2%, Q2 growth was 4.2%, and Q3 growth is expected to breach 5%, according to the latest estimates. U.S. consumer confidence is also at an 18-year high, and recent data is showing that manufacturing output and productivity are at their highest levels in three years. To top off the strong economic performance, retail sales have continued to increase throughout the year, a number that will surely skyrocket in Q4.

Although foot traffic may decrease at retail stores, it fell by 7.5% in November and December of 2017, ecommerce is expected to drive holiday sales. The 2017 holiday season saw a 14.7% increase in online sales, which rose to $108.2 billion. As consumer trends continue to push online shopping, optimizing parcel, LTL and partial load shipping strategies will be critical for retailers.

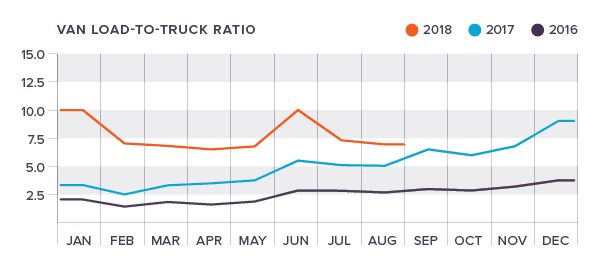

Hurricanes and holidays cause unrest in the DAT Van Load-to-Truck Ratio

The latest DAT numbers show continued decreases since June, where the ratio hit a high of 10.0 loads per truck. While numbers in early September were expected to heavily decrease by about 20-25%, a result of the short work week due to the Labor Day holiday, the DAT load boards only posted a 6% decrease overall. Increased demand was placed on the spot market due to FEMA’s preparations for Hurricane Florence.

In August, van truck posts increased by 11% while load posts ticked up slightly (1%) over their July numbers. These increases caused the van load-to-truck ratio to fall from 7.3 to 6.7 loads per truck. While the van load-to-truck ratio continues to decrease, the 2018 August numbers were still 29% more than the posted numbers in August 2017.

Is the Capacity Crunch letting up?

For many months now, the talk of the industry has been the looming capacity crunch, and numbers from our Q2 report showed no signs of it letting up. Carriers were reporting a 400% increase in turndown rates over the previous year, and ELD mandates were pushing more carriers off the road.

The latest turndown rates are indicating that the crunch may be easing. August was the slowest month of the year for turndowns. The Tender Reject Index plummeted from almost 27.50 in July to a low of 17.16 in August, giving carriers significantly fewer options over available loads.

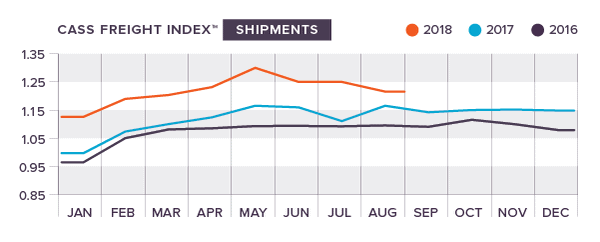

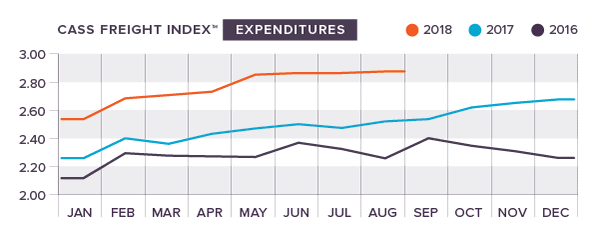

The Cass Index shows shipments down, expenditures up

The Cass Freight Shipments and Expenditures Indices in Q3 continued to demonstrate, from both a pricing and volume perspective, that the U.S. freight economy is very strong. Shipments have decreased since they reached 1.307 in May, their highest number of the year – they sat at 1.227 in August – and expenditures have continued their 23-month increase, rising to 2.917, a 16.7% increase over last year.

The Tonnage Index makes a recovery

After dipping 0.5% in June, the Seasonally-Adjusted Tonnage Index jumped by 1.9% to 115 in July. This is also a large year-over-year increase of 8.6%. This far exceeds the annual gains of 3.8% for the same period in 2017. The American Trucking Associations attribute these increases to the manufacturing, retail and construction industries.

High diesel fuel prices refuse to let up

With small changes in Q1 and steady increases in Q2, diesel fuel prices remained steady throughout Q3. Prices fluctuated slightly between a high of $3.258 per gallon in the week of September 10th and low of $3.207 in the week of August 20th. Prices remained firmly above $3.20 for the entire quarter for the first time this year, leaving no indication that they will drop anytime soon. Rising diesel fuel prices are a consistent concern for shippers, and recent trends have given no indication that there will be significant drops in prices during the holiday season.

What’s happening at King?

Q3 really flew by for our team here at King. Our newest facility in Chicago had its grand opening, bringing our fulfillment and USPS destination entry services to the Windy City.

We were also selected by the EPA as a 2018 SmartWay High Performer, a title that is given only to the top 5% of SmartWay logistics service providers who meet the required emissions and carrier selection criteria set forth by the EPA. This achievement is a big honor for our company, but ultimately creates even more solutions for our clients: efficient methods of shipping that result in smaller carbon footprints.

Speaking of carriers, did you remember to thank a trucker during National Truck Driver Appreciation Week? To show our appreciation for the true kings of the road, we put together a short video recognizing their hard work.

![]()

![]()

Get ahead of the year-end rush

Before you know it, the holidays will be here. And we’re already optimizing supply chains for the inevitable surge. Ready to talk distribution solutions for your business? So are we. Contact King today.

Joel Rice

Joel Rice