The summer season brings with it BBQs, bright sunshine and booming markets. Summer is the second highest consumer spending season (behind winter, which brings with it the holiday season). As a result, the economy and the shipping industry should keep pace with the growth and excellent numbers they have seen all year.

But we’re getting ahead of ourselves! Before we start talking about what Q3 will bring to the industry, let’s dive into the numbers from Q2. (Feeling behind in the industry news? Read our Q1 report from earlier this year).

The data is in. Here are the Q2 numbers from the shipping and logistics industry:

A quick look at GDP

GDP growth for Q2 sustained the healthy trend seen over the past few months. April came in at 3.2% while May and June experienced 3.1% growth. The only concern for the economy at the moment is the looming “trade war” between the United States and China. Tariffs are in place, and shippers are adjusting to them, but further tension between the countries could lead to uncertainties in the market and logistics industry moving forward.

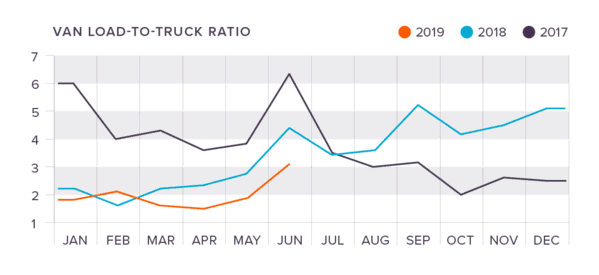

DAT numbers follow previous trends

The DAT van load-to-truck ratio is following the same trendlines we saw in 2018 and 2017, with the numbers beginning to increase in April and sharply spiking in June. The load-to-truck ratio (the number of loads posted for every truck) hit a low for 2019 in April (1.45) before increasing in May (1.77) and drastically increasing in June (reaching as high as 3.13). DAT also reports that, although van rates are lower this year than they were in June of last year, freight volume is on pace with June of 2018. Total freight volumes are up from last year by 6%.

Note: as we mentioned in our last report, DAT changed the way they measure their Van to Truckload Ratios as of March, 2019. If the numbers seem off to you, please visit their website to see the new way they calculate their ratios.

If trends continue as they have over the last few years, we should see these ratios fall in August and September before beginning their climb again in September.

The national freight rates ended June at:

- Van: $1.89

- Flatbed: $2.30

- Reefer: $2.25

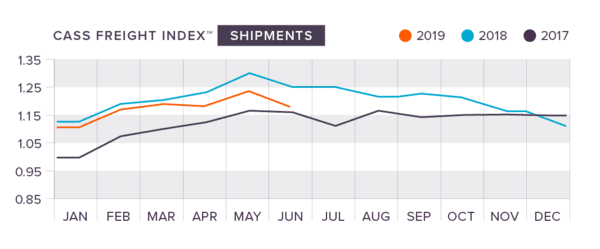

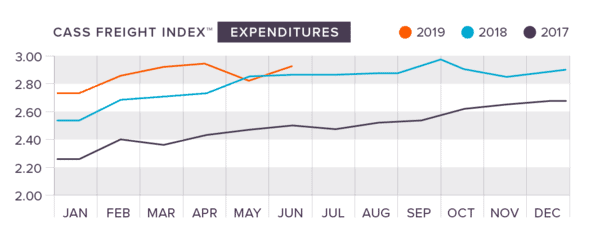

Expenditures are up as shipments drop

The Cass indices show that May was again a heavy month for shipments, following the trend set last year. Shipments reached a 2019 high of 1.23 before dipping again to 1.16 in June. Although following the same trends as 2018, the number of shipments are down (compared to 1.31 in May and 1.25 in June of 2018).

Although shipments are down from last year, expenditures have not followed the same trendline. Expenditures in April hit a 2019 high of 2.909 before dipping in May to 2.845. Expenditures were on the rise once again in June (2.894) and should continue to climb throughout the summer. With the exception of May, expenditures have outpaced those in 2018 every month this year.

The Tonnage index has its ups and downs

The American Trucking Associations’ (ATA) seasonally adjusted tonnage index fell by 2.3% in March, continuing its push downward after a 1.5% dip in February. The March index ended up at 113.2, which is still 1.6% higher than it was in March, 2018. The index sharply recovered in April, increasing by 7.4% to 121.8. This gain leaves the index 7.7% higher than it was in April, 2018. The ATA notes that this increase was likely due to Easter falling so late in the month of April, pushing freight that would normally have been shipped in March into April.

May was not a better month for the tonnage index, taking a 6.1% decline after its sharp increase in May. The index ended the month of May at 114.

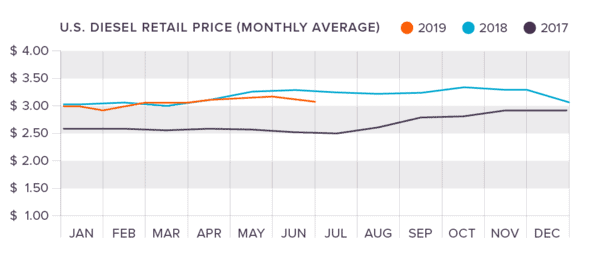

Diesel prices jump in May, then level off

Diesel fuel prices are almost 60 cents higher than they were last year, but despite the year-over-year increase, they have leveled off compared to prior months. The most major jump in price in Q2 was from April to May (from $3.078 to $3.171), but that high in May saw a decline by June ($3.136). Even better news: prices have declined again in July, moving down to $3.042.

New pricing from the USPS

One major industry update came in June as the USPS announced the implementation of a new dimensional pricing structure. Already in effect, this new structure changes the dimensional divisor (DIM) for boxes that exceed one cubic foot in volume to 166 (previously 194) and will apply to all zones. This change could affect the classified weight and price to ship packages. Learn more about the new rule here.

King is keeping things cool this summer

As the summer heat takes its toll, King is focused on keeping things cool this summer. In addition to the breadth of customizable shipping and fulfillment services, we now also offer temperature-controlled warehousing and shipping from our Minneapolis-based facility. Looking to keep your products cool this summer? Contact King to start talking solutions!

Joel Rice

Joel Rice