We are well into the holiday season, Christmas and New Years are right around the corner and the logistics industry is booming. Trucking industry volumes are expected to grow 4.2% for 2018, and the economy is showing very strong signs of continued expansion. While GDP growth is expected to slow down from the +4% growth we saw in Q3, economists still expect to see mid 2% growth in the coming quarters. This is on top of increasing consumer confidence and a 4% growth in consumer spending.

What about the logistics industry?

How has the year been going for the logistics industry? If you haven’t been closely following the trends, you can catch up on the numbers by reading our prior quarterly reports. See how things have changed over the course of the year:

Read the Q1 Report: see how strong the year began!

Read the Q2 Report: see how ELD mandates affected capacity

Read the Q3 Report: see how hurricanes and holidays caused some unrest

Without further ado, let’s end the year with our final logistics report!

DAT trendlines bounce back, but trail last year

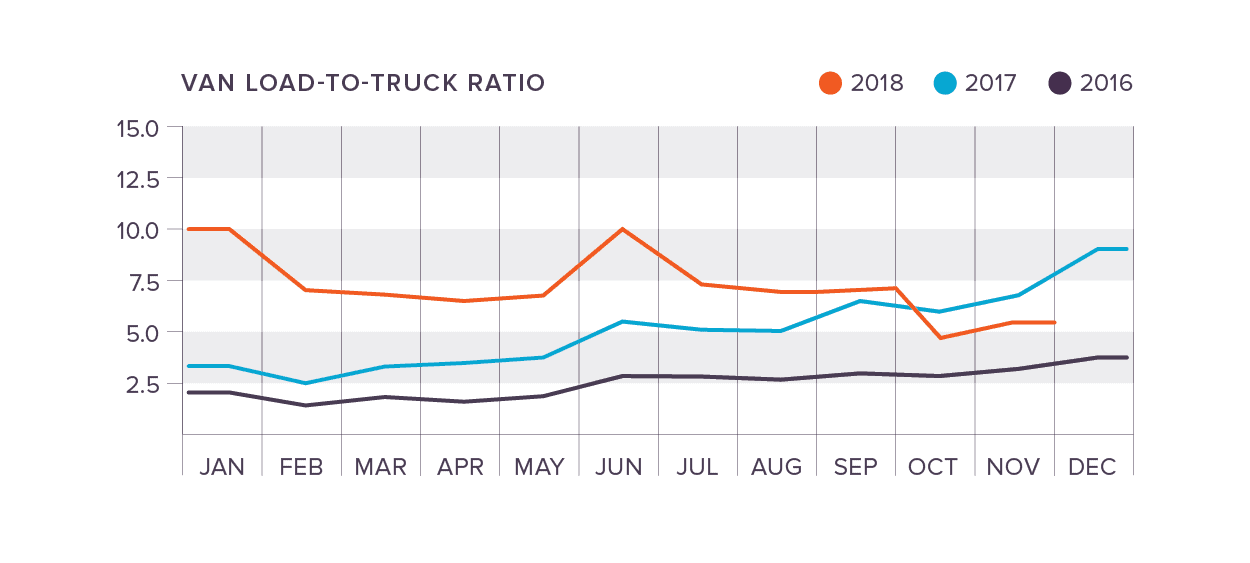

As we observe trends and rate changes heading into the end of the year, the DAT Load-to-Truck Ratio is the place to begin. Load-to-truck ratios represent the number of loads posted per truck on the DAT Load Boards and offer a real-time look at the correlation between demand on the spot market and capacity.

The Q3 DAT numbers showed consistent decreases in the load-to-truck ratios since June, with a heavy plunge to 5.0 in October. This was largely due to the increased demand placed on the spot market caused by FEMA’s preparations for Hurricane Florence.

So far in Q4, the van load-to-truck ratio bounced back heavily, increasing from 5.0 to 5.6 loads per truck (a 14% increase) in November. The most recent numbers have the ratio at 7.2 loads per truck, but these numbers are still trailing those posted in Q4 of 2017.

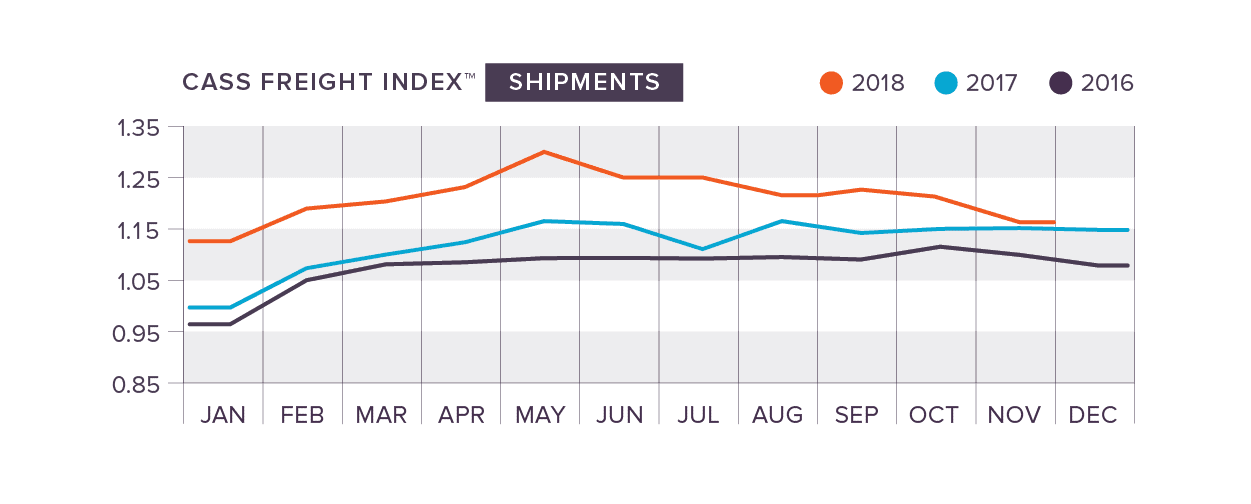

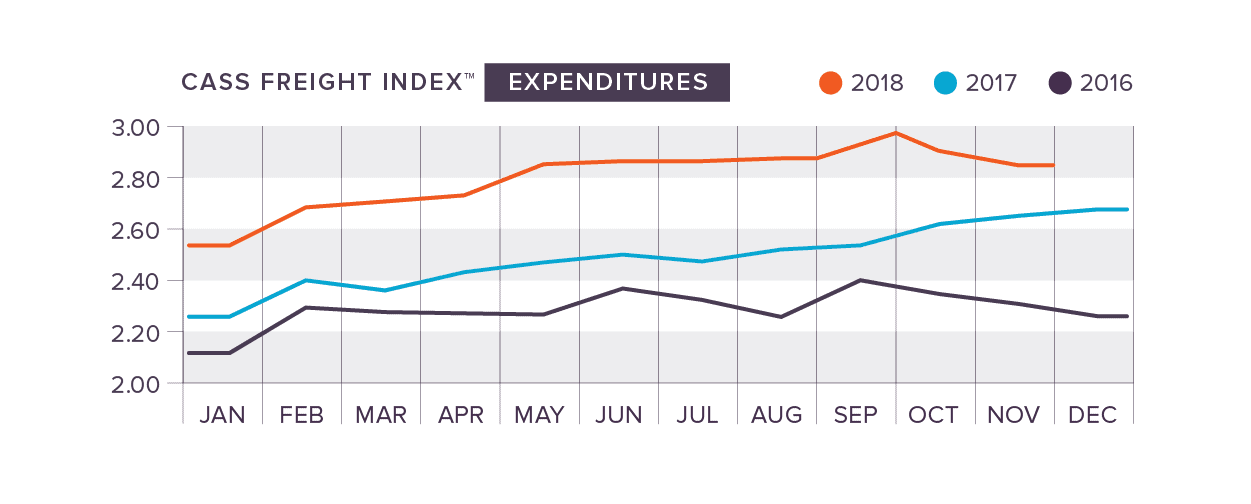

Shipments and expenditures drop after the holiday rush

The Cass Indices reported big decreases in both shipments and expenditures. As the year comes to a close, this is to be expected. November is not as strong of a seasonal month as September and October, and the holiday rush is usually coming to an end. Despite the big decline this year in terms of month-over-month numbers, shipments and expenditures are still up .6% and 8.4% over last year, respectively.

Tonnage Index surges as companies brace for tariffs

After falling over 2.5 percentages points throughout August and September, the seasonally adjusted Tonnage Index made a huge comeback in October, increasing 6.3% (from 112.8 to 119.9) ahead of the holiday season. Truck freight has surged over these past two months, mostly due to strong import numbers on the West Coast. This is likely the result of the fear of tariffs that are set to begin in January. We expect to see more companies begin to brace for these tariffs by stocking up on imported goods and materials.

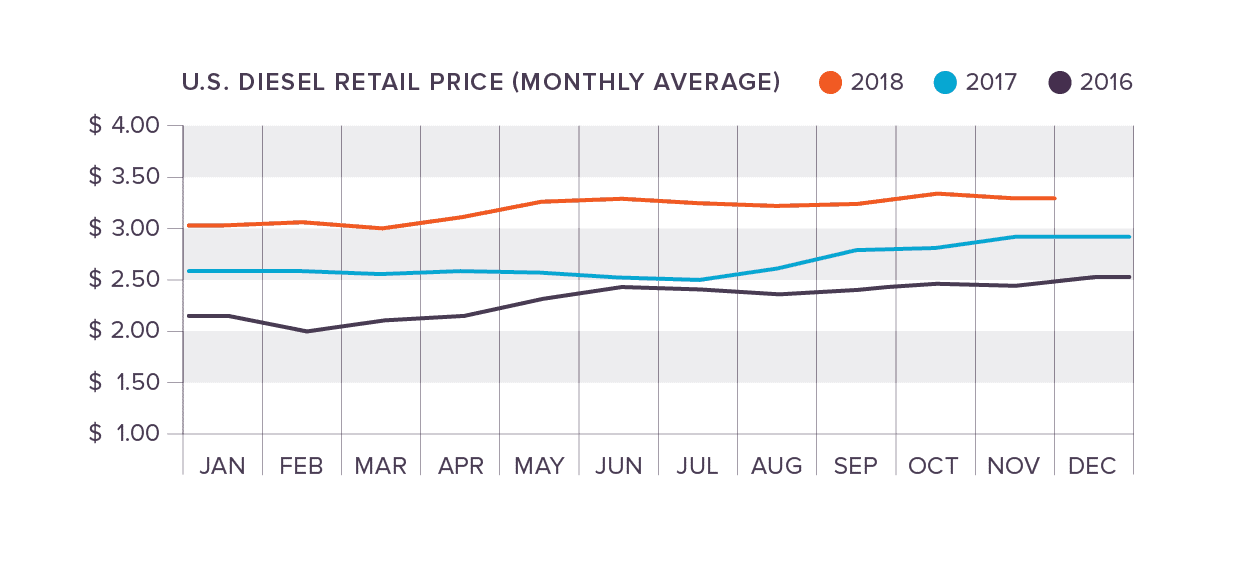

Diesel fuel prices let up (finally!)

If you’ve been following our quarterly reporting, we’ve unfortunately been the bearer of bad news regarding diesel prices. Average U.S. prices started the year at $2.973 and continued an upward trend for most of the year.

The good news? After hitting $3.394 per gallon on October 15th, this year’s highest price point, average diesel fuel costs finally began to inch downward throughout the remainder of October and November! As of December 3rd, average prices hit $3.207 per gallon, the lowest they have been since August 20th. While we’re excited to finally have some great news regarding the price of diesel fuel, we’ll hold off on the celebration until we are certain this downward trend will continue.

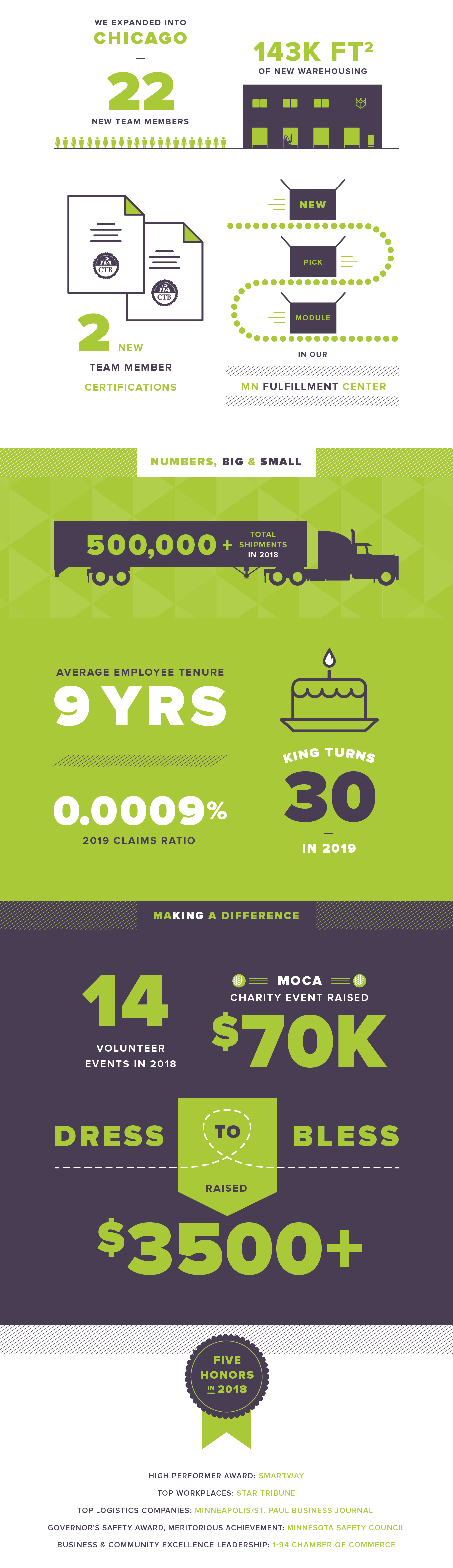

Catching up with King

2018 was an incredible year at King, and it was all thanks to our clients, carriers and employees. Here’s a look at what we’ve been up to this year.

Looking ahead to 2019

One last bit of great news: King turns 30 years old next year! But enough about us, let’s talk about you. We want to hear your logistics plans and goals for 2019, and we’re excited to tell you how we can help. Get in touch with King to start talking solutions!

Joel Rice

Joel Rice