While 2023 was a hard year for the economy and the logistics industry, we did end on a strong note. Looking ahead to 2024, with the first quarter numbers in, we can say one thing: the economy has stabilized. However, another big question remains: can we now see significant growth? As for the logistics industry, there’s a lot of uncertainty, but the numbers do show that there is nothing major to fear on the horizon.

Are we at an economic turning point? How has the year started from a freight standpoint? See the latest news and data in our industry report.

Catch up on the Q4, 2023 Data

Want to see how last year ended? Read our Q4 2023 Logistics Industry Report.

The Economy Continues to Grow, Slowly

Increases in consumer and government spending and fixed investments pushed economic growth in Q4, 2023. Real GDP increased throughout Q4 by 3.4%, but growth cooled in Q1 to 1.6% annualized. This growth was well underestimates by the Federal Reserve bank of Atlanta, which puts Q1 GDP growth at 2.9%.

Consumer Confidence, Jobs, and Manufacturing Output

The latest consumer confidence reports presented a mixed bag of optimism and pessimism. Consumer confidence in the present is remarkably high, with the Present Situation Index increasing to 151 in March. The short-term outlook for businesses and market conditions remains good, but consumers are clearly worried about the future. The Expectations Index decreased almost three points in March, dropping to 73.8. An Expectations Index of below 80 is often a sign of a potential recession on the horizon.

While the view of the economy may be uncertain, the latest Employment Situation Summary from the Bureau of Labor Statistics was a resounding improvement over prior months. The report beat expectations of job growth, showing the creation of 303,000 nonfarm payroll jobs in March. Most job gains were in healthcare and government roles, with little change in major industries (retail, transportation, manufacturing, etc.)

Unemployment remains at 3.8%.

After seeing a massive gain in December, manufacturing output also dipped 1.5% in January and 0.5% in February, erasing many of the gains brought by the “December surprise” of last year. The decreases were short-lived in Q1, as output increased yet again in March by 0.8%. Manufacturing is not out of the woods yet, as the Federal Reserve has given no indication of rate cuts later in the year, which could force a recession to combat inflation rates.

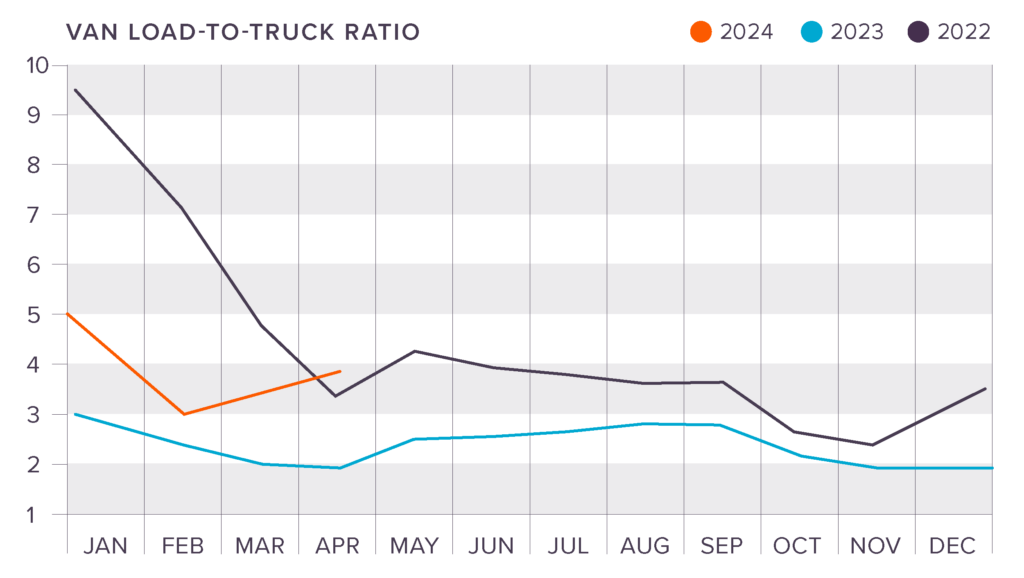

Capacity Levels Out in Q1

After starting the year at 4.79 loads per truck in January, the highest it’s been in almost two years, van capacity leveled off as we moved through February and January. Capacity remains stagnant as carriers search for drivers to haul loads. While freight levels remain manageable, carriers are concerned that capacity will tighten as the markets are expected to turn and sales increase this year.

National Spot and Contract Rates at the end of March were:

- Van: $2.01 (Spot) and $2.47 (Contract)

- Flatbed: $2.52 (Spot) and $3.21 (Contract)

- Reefer: $2.32 (Spot) and $2.82 (Contract)

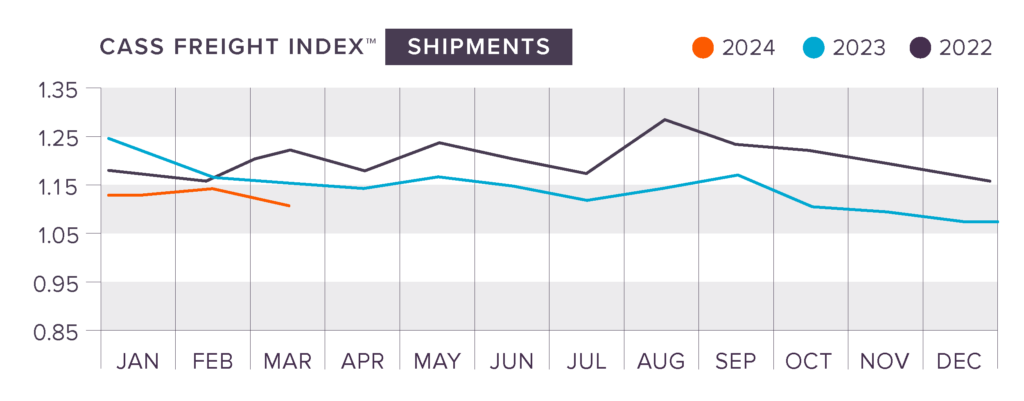

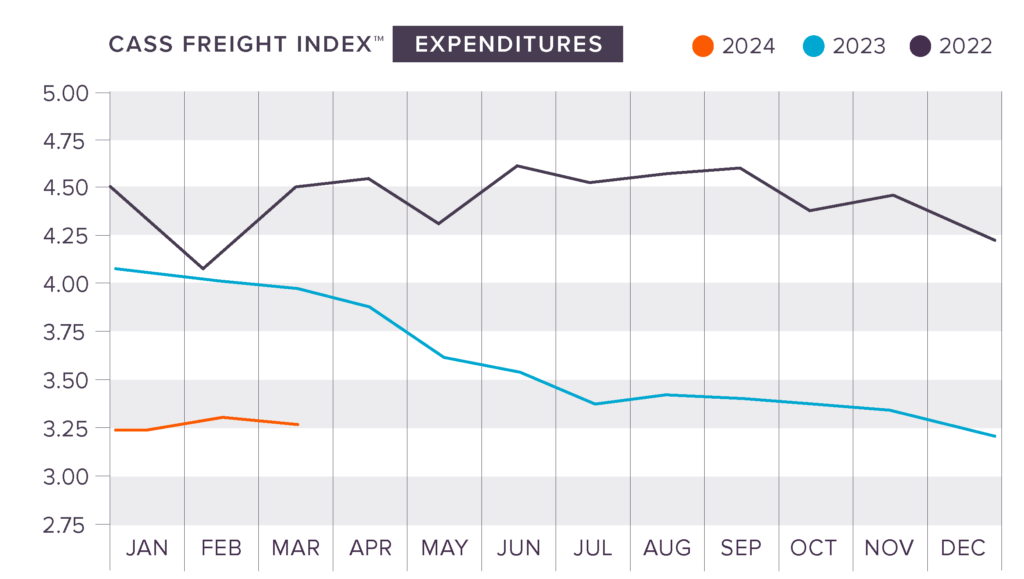

Freight Expenditures and Shipments Rise in Early 2024

Q1 saw marginal increases in freight shipments and expenditures, beating out the decreases seen in Q4 of last year. The Cass Shipments Index declined by 3.5% m/m in January. Expenditures also fell by 4.0% m/m, which is in line with seasonality and trends from prior years.

Both the Freight Index and Shipments Index rose in February (up 7.3% m/m for freight and 4.0% m/m for expenditures) as the weather softened and freight levels returned to normal. Freight levels and expenditures are still lower than last year, but the year-over-year decrease in February (-4.5%) is the smallest decline in ten months.

March brought little changes to freight levels, with shipments falling 0.2% m/m and expenditures rising 0.1% m/m. Looking at the totality of Q1, freight volumes have increased, which is a good sign as we head into the summer months.

Tonnage Remains in Recession Territory

The harsh winter weather seen in January also caused the seasonally adjusted Tonnage Index to dip heavily, dropping 3.2% in January. These numbers marked the 11th straight year of decreases in January, as drops in driver numbers, sales, and output continue to struggle.

The Tonnage Index did snap back in February, increasing by 4.3%. This major increase was the highest we’ve seen in a year, but the American Trucking Association remains hesitant to declare truck freight out of the recession it’s been in.

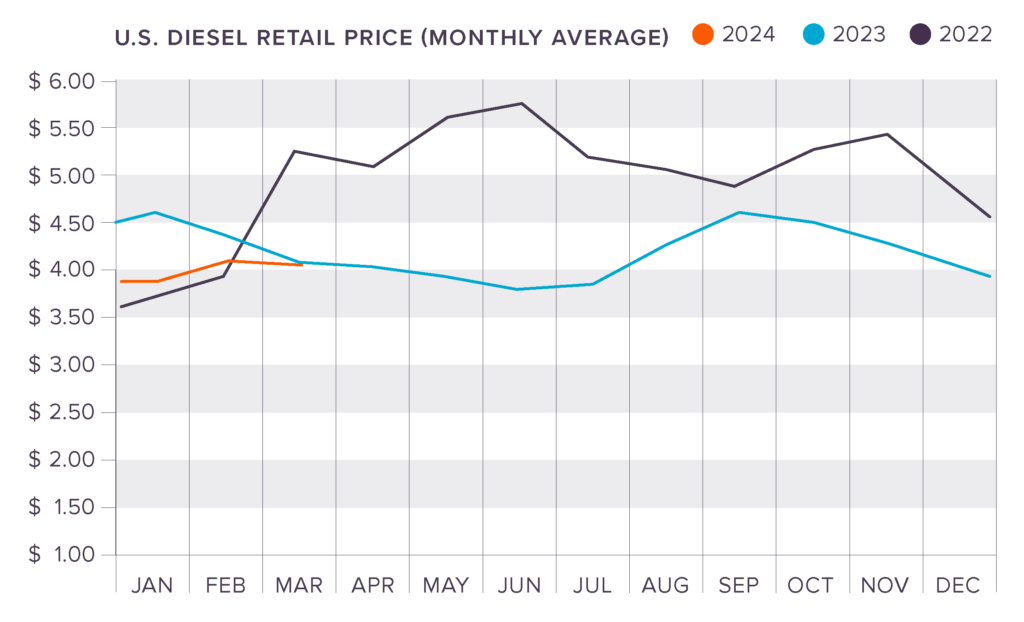

Diesel Fuel Prices are Back Above $4.00 Per Gallon

After trending downward at the end of 2023, diesel fuel prices have climbed once again in Q1 2024, breaking the $4.00 per gallon mark. Price increases have been attributed to a range of factors, including war in the Middle East, refinery issues, and the inevitable switch to summer grade gasoline.

As of the writing of this report, diesel fuel prices are at $3.848.

Bring Visibility, Efficiency, and Security to Your Supply Chain

How are you feeling about your shipping strategy in 2024? It’s not too late to make a change. At King Solutions, we’re here to analyze everything from your warehousing to your shipping modes and the technology you use, helping you achieve the goals and KPIs you established for this year. Get in touch with today to talk about your goals, supply chain issues, and how we can fit into your business as you scale.

Joel Rice

Joel Rice