2023 was a mixed year for the economy and the logistics industry. The first half of the year brought hefty challenges—rising inflation, faltering manufacturing output, negative GDP growth, falling consumer confidence. Things did not look good heading into the back half of the year.

Despite these challenges, the year ended on a surprisingly strong note. The latest figures from the economy show that nearly every metric is improving, but there is still work to be done.

How did 2023 end for the logistics industry? See the latest news and data in our industry report.

Catch up on the Q3 Data

Need to catch up? Read our Q3 2023 Logistics Industry Report.

Unexpected Economic Growth Provides a Much-Needed Boost

Q3 GDP growth far exceeded expectations, increasing by 4.9 percent in one of the best showings of the year. This gave the economy a much-needed boost heading into the end of 2023, and economists are now predicting slowed but positive growth in Q4. Federal Reserve banks are expecting anywhere from a 1.5 to 2 percent increase for Q4, which will retain the momentum needed as we move into the new year.

Consumer Confidence and Manufacturing Show Good Signs for 2024

Consumer confidence had a great second half of the year. After reaching its highest point of 2023 in July, slightly stumbling in August and September, the Consumer Confidence Index® ended the year strong in December, increasing to 110.7. Current business conditions, job availability, and more positive views of personal income prospects are driving renewed optimism among consumers, projecting a bright outlook for spending in 2024. The top issues impacting consumers right now is rising prices, but inflation is nearly a third of what it was when it peaked in June of 2022.

The December employment situation gave mixed signals. While the BLS December Jobs Report showed a gain of 216,000 non-farm payroll jobs, there was a decline of 23,000 jobs in the transportation and warehousing sector. Retail, manufacturing, and many other supply chain sectors also saw little change in job growth. While the employment situation overall in the US looks bright, supply chain job growth is not leading the charge.

The biggest surprise in December came from manufacturing production in the US. Manufacturing output increased for the first time since January rising by the highest level (1.2 percent y/y) we’ve seen since October 2022. This followed total decreases of 1.94 and 0.965 in October and November, respectively, but the outlook moving into 2024 finally looks bright for the manufacturing sector.

Capacity Dips in Q4, but Remains Relatively Stable

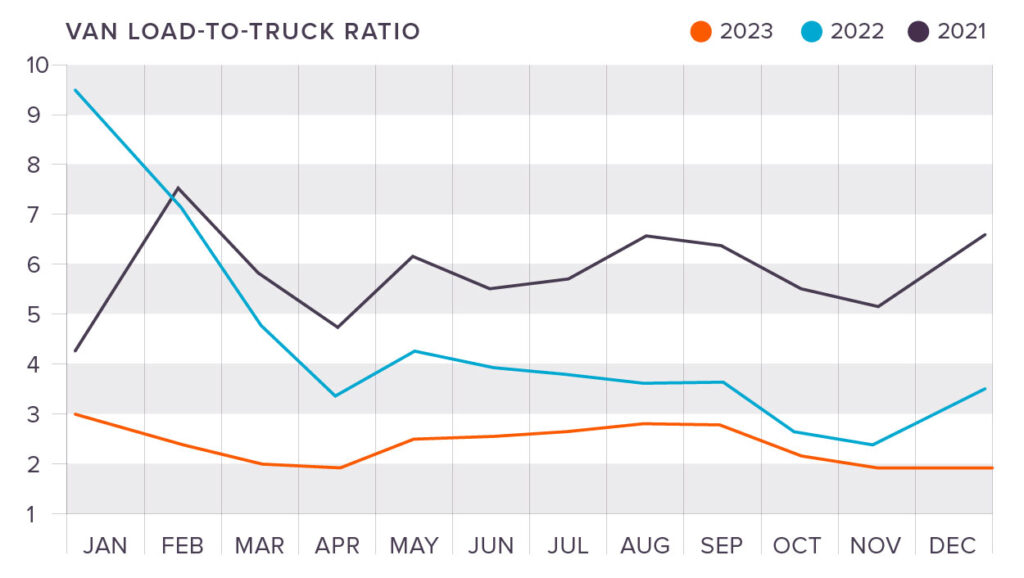

Van, Flatbed, and Reefer capacity were relatively stable in Q4, only dropping slightly as we moved through the holiday season. Capacity was tighter than we saw in 2022, but the load to truck ratio still followed seasonal trends in prior years.

National Spot and Contract Rates at the end of December were:

- Van: $2.11 (Spot) and $2.49 (Contract)

- Flatbed: $2.42 (Spot) and $3.09 (Contract)

- Reefer: $2.48 (Spot) and $2.90 (Contract)

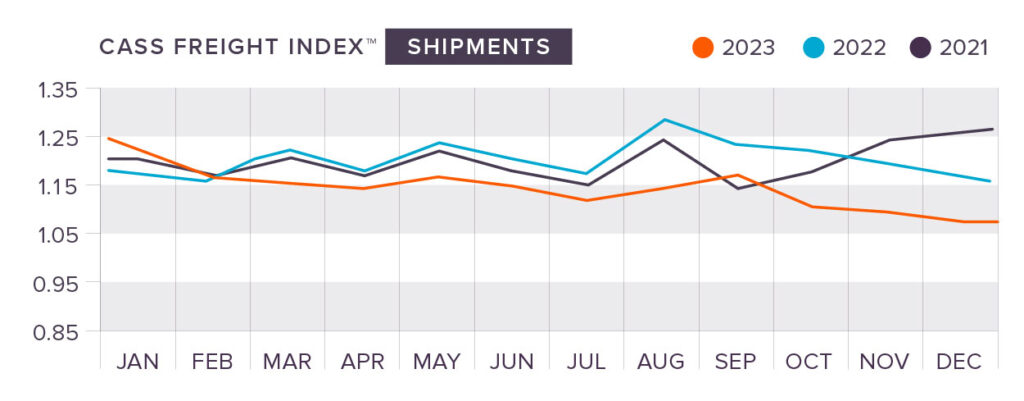

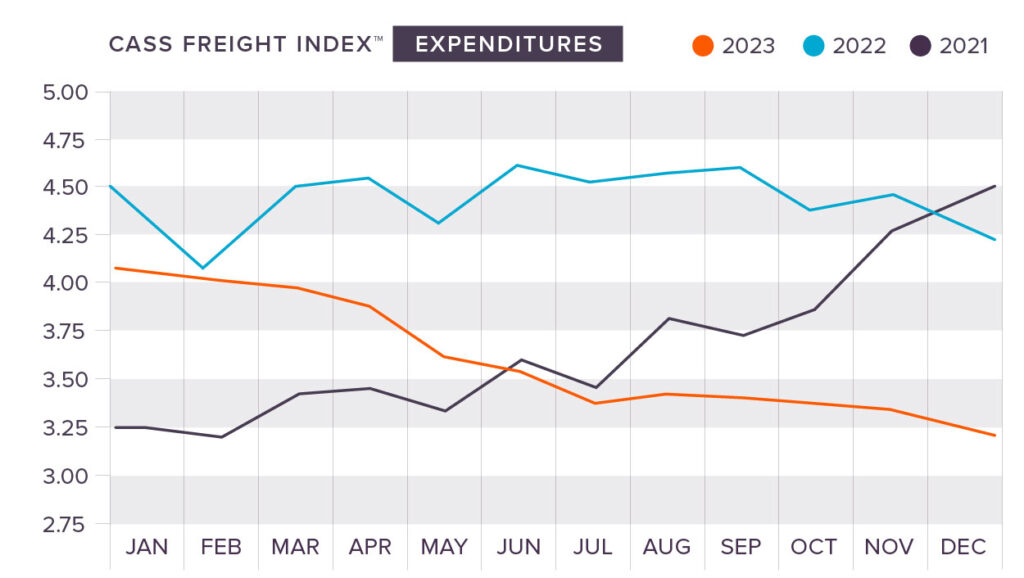

Freight Expenditures and Shipments Decline, then Stabilize in Late Q4

Q4 saw sharp declines in both freight volumes and expenditures, according to the latest numbers from the Cass Shipments Index and Cass Expenditures Index. Freight shipments saw consecutive declines in October (falling 4.7 percent m/m), November (falling 1.3 percent m/m), and December (falling 1.6 percent m/m). Expenditures also fell in October (falling 2.2 percent m/m), November (falling 1.3 percent m/m), and December (falling 3.0 percent m/m).

The brunt of these declines impact carrier fleets more than shippers, as freight volumes have continued to fall for the past two years. Historical trends predict that these declines will continue into Q1 2024, particularly in January, but increases in real disposable incomes in the US, combined with sharp disinflation and a strong labor market, suggest that we should see some improvements in freight volumes throughout 2024.

Tonnage Remains Choppy, but Steadily Inclines

After bottoming out in April, tonnage slowly improved throughout the second half of 2023. However, we are still below the recent peak we saw in September of 2022. There were increases in October (by 0.8 percent), but those were offset by yet another decline in November (by 1 percent). ATA Chief Economist, Bob Costello was quoted saying, “It seems like every time freight improves, it takes a step back the following month. While year-over-year comparisons are improving, unfortunately, the freight market remains in a recession. Looking ahead, with retail inventories falling, we should see less of a headwind for retail freight, but I’m also not expecting a surge in freight levels in the coming months.”

The Tonnage Index is still lagging from its height in 2022, but there’s a trend of steady increases if you look at the numbers over the course Q3 and Q4, 2023. However, month-to-month volatility is stopping freight analysts from expecting big gains in the coming months. Overall, the outlook is good, but no one is expecting massive surges early on in 2024.

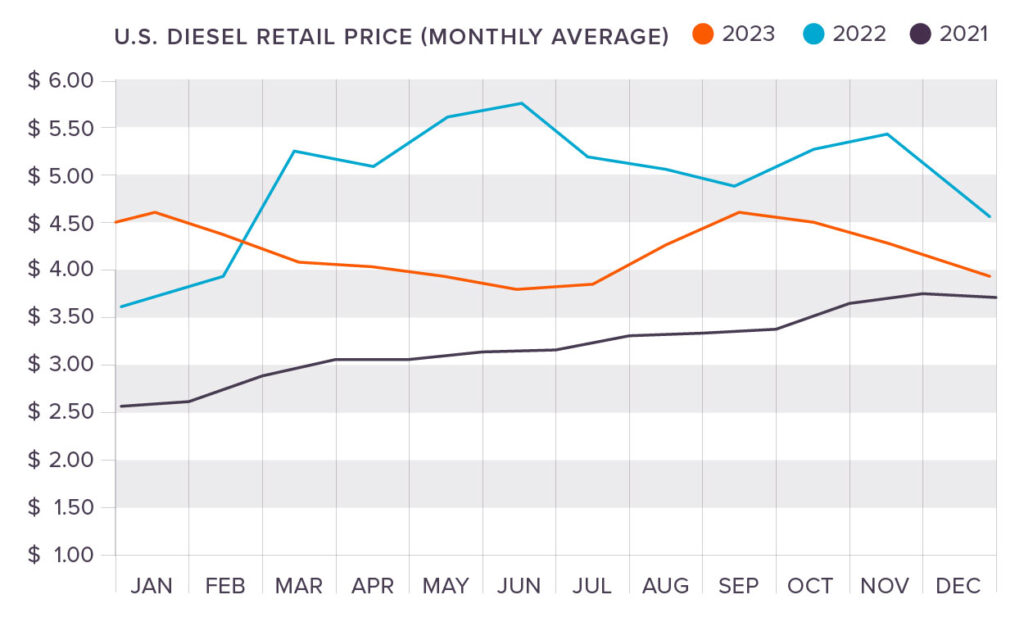

Diesel Fuel Prices Provide Relief at the End of the Year

One of the best gifts of the holiday season was lower fuel prices for shippers. After almost five months of consecutive increases from June through October, diesel fuel prices finally began to drop in late October and continued a progressive decline throughout the end of the year. Prices per gallon hit as low as 3.894 in mid-December and finished out the year at 3.914.

Price declines have continued throughout the beginning of 2024. As of the writing of this report, diesel fuel prices are at 3.867 per gallon.

It’s 2024. Change the Way You Ship This Year

What are your logistics goals for 2024? Give us a call to let us know! We work with businesses to help them optimize the way they store and ship freight. Whatever you send, and wherever it is going, King Solutions can help. Our logistics experts are ready to help you bring reliability, visibility, and affordability to your supply chain this year! Give us a quick call or send us an email to set up a free consultation!

Joel Rice

Joel Rice