2020 has been unlike any year we’ve ever experienced before. As we move towards the future, we can take comfort in something a bit more concrete: industry stats and numbers. Before you hit the pavement and press on into the uncertain times that are surely ahead of us for the remainder of 2020, King is bringing you the Q1 numbers from the logistics industry.

Need to get caught up? Read our last report from 2020.

As we move forward, know that you can always count on King to bring you open and honest insights from our industry, so here are the numbers from the beginning of this year.

The economy started strong

There are two US economies to look at in Q1 2020: pre-COVID-19 and post-COVID-19. The onset of nationwide lockdowns in March took a surging economy and slowed it greatly, resulting in losses all over the board. Nearly every industry in the nation is feeling the effects of heavy shutdowns, quarantines and other effects brought on by the global spread of COVID-19.

GDP growth in Q4 of 2019 ended at around 2%, according to the BEA, and estimates were putting Q1 of 2020 to be around the same pace of growth. Current projections place a net loss in GDP growth of up to 8% in Q1 and a decrease of up to 30% for Q2.

Jobs numbers were also booming in the first two months of 2020. The February jobs report released by the BLS “smashed expectations” by adding 273,000 non-farm payroll jobs to the economy, with a drop in the unemployment rate to 3.5%, the lowest it’s been in 50 years. The March jobs report did not fare so well. Shutdowns of businesses across all industries led to a net loss of 701,000 jobs and an increase in the unemployment rate to 4.4%. Current projections estimate that the situation could worsen as shutdowns and quarantines continue in Q2.

Consumer confidence was the only metric that held strong in Q1, which can be attributed to concerned shoppers rushing to stores to stock up on goods for the next few months. Concerns of price increases and product shortages created a heavy surplus of shoppers hitting both brick-and-mortar stores and online retailers in late February and all throughout March.

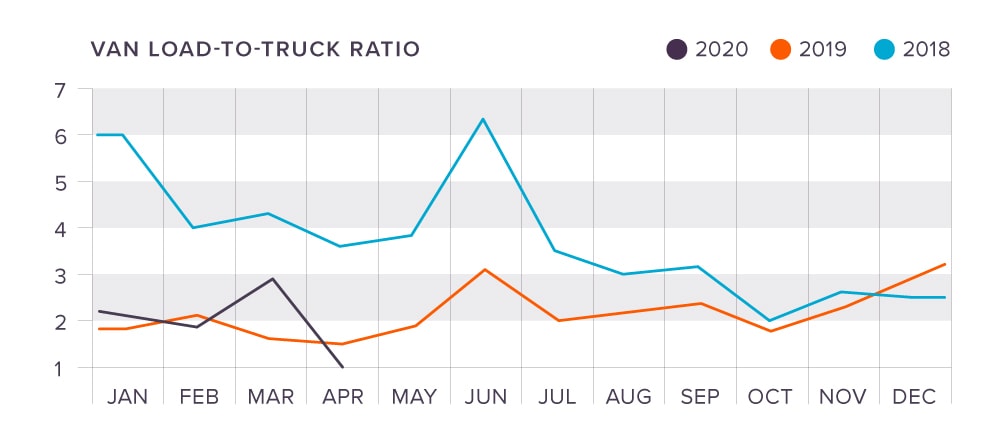

Van rates surge in March, expected to fall in Q2

Many jobs can be done from home; truck driving is not one of them. We’d like to take a moment to thank all the drivers across the country who have been continually out on the road, delivering the nation’s freight, even as the businesses across the country have closed. Although deliveries to brick-and-mortar stores are down, online orders and deliveries are peaking as people continue to stay home.

The DAT trendlines showed a surging peak in March, putting the Van-to-Truckload ratio at 2.89 loads per truck. Rates have also been rising for reefer equipment over the past few weeks, with 71 of the top 100 high-volume spot lanes seeing an increase. National rates at the end of March were:

Van: $1.87

Flatbed: $2.19

Reefer: $2.19

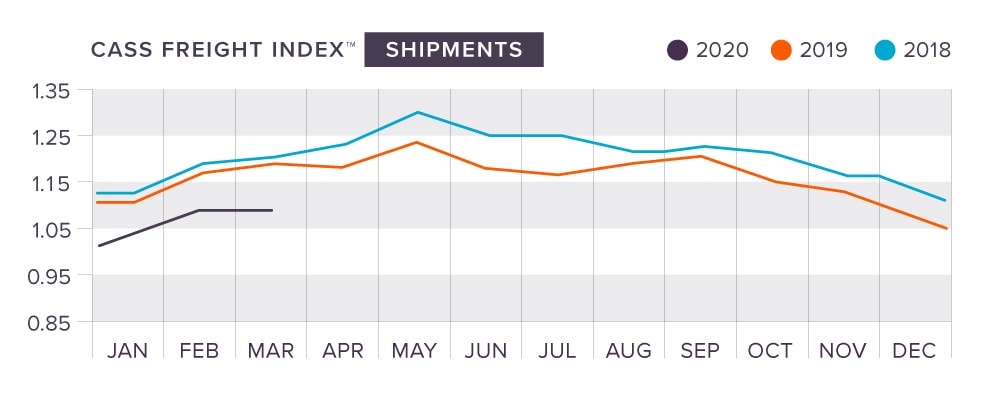

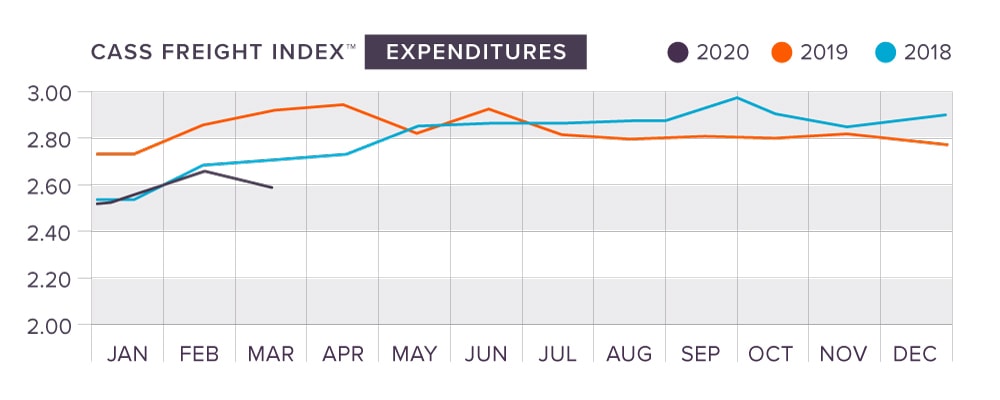

Shipments flatten and expenditures plunge

The Cass Indices show that shipments are way below Q1 numbers in 2019 and 2018, and their rise in January and February were completely halted by the shutdown that occurred in March. Expenditures did not fare better. All Q1 numbers are below the 2019 and 2018 numbers and fell sharply in March. It’s hard to say what future months will bring, but the trends are pushing shipments and expenditures towards 2017 levels. Cass noted a clear divide in products, with groceries and home improvement items coming out as winner, while restaurant, auto and mail retail plunged to almost zero volume.

Looking at the future, Cass does not predict inventory levels to fall. Since consumers are not out shopping, there isn’t much of a need for manufacturers in China to play catch-up. Ocean freight volumes are slowing, and many containers are even being left unopened at ports on the US coasts. Retailers and warehouses should be ready with stocked shelves once the economy reopens.

Tonnage index was showing strong signs in early 2020

The American Trucking Associations was pleasantly surprised at the rising tonnage index in January and February, even after a strong increase in December 2019. The index fell by 0.3% in January and rose by 1.8% in February, showing remarkable signs of strength leading into the end of Q1. The index reached 119.1 by the end of February, an increase of 1.5% compared to the same two months last year but is expected to fall when the March numbers are released over the coming weeks.

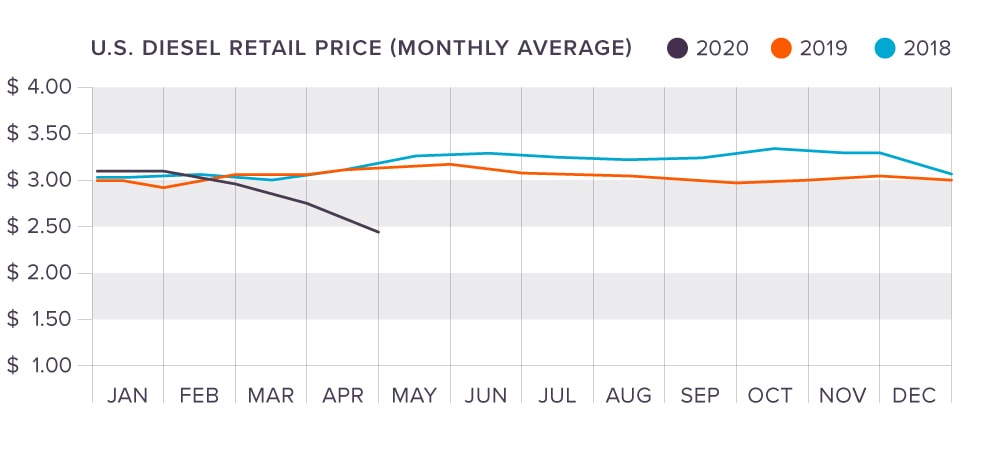

Fuel prices continue to drop

After rising for three consecutive months in Q4 2019, diesel fuel prices began their largest decline in years through Q1 of this year. Prices started the year at $3.079 per gallon and have dropped way down to $2.586 by the end of March. These decreases have continued into the month of April and will likely drop even more in the coming weeks.

The decline in diesel fuel prices is due to a combination of many factors. Leading the way is a price war between OPEC and Russia, which is furthered compounded by a the COVID-19 pandemic and other global factors.

Uncertain times are ahead, but King is ready

While the course for 2020 remains to be determined, King is ready to serve our clients along the way. Our team is monitoring global and domestic events, and we’re ready to support our clients with their supply chain needs: transportation management, warehousing and fulfillment. If we can help your business, please contact us today.

Joel Rice

Joel Rice