2020 has arrived, marking the end of not only a new year, but the decade as well! The holidays are over, winter is in full gear and businesses are starting their engines and revving up their plans for the new year. Before you get started on planning your next move, take a moment to review our Q4 report, which is filled with industry statistics, current news and a look into what we can expect in 2020.

Need a recap of 2019? Read our previous industry reports from last year:

All caught up? Let’s review how the economy and the logistics industry faired in Q4 2019.

The economy, jobs and consumer spending habits

After a dismal Q4 in 2018 (GDP was at 1.1%), the economy came into 2019 firing on all cylinders. GDP growth was at 3.1% and consumer confidence and the stock market were on the rebound. Although GDP numbers would dip in the following quarters (hitting 2% and 2.1% in Q2 and Q3, respectively), growth would remain stable throughout the entire year. The final Q4 GDP numbers will be released at the end of the month, and economists believe they will remain flat (hovering around 2%).

Consumer confidence saw a 4% increase throughout Q4. Coming off a year-long low of 89.8 in August, the Consumer Confidence Index saw large increases in October (to 95.5), November (96.8) and December (99.3).

Looking ahead, economists are predicting that the economy will continue to grow, but depending on extenuating circumstances —particularly the unfinished trade deal with China — there could be a rocky road for businesses going into 2020. Unemployment is still at record lows (3.5% in December), and the stock prices continue to rise, but trucking companies in particular seem to be struggling. 2019 saw the bankruptcy of Celadon Group, New England Motor Freight, and several other major carriers and trucking companies, resulting in thousands of jobs lost for the industry. While the outlook of the logistics industry is, for the time being, uncertain, recent economic trends do not point to a recession or any major concerns for the industry in 2020.

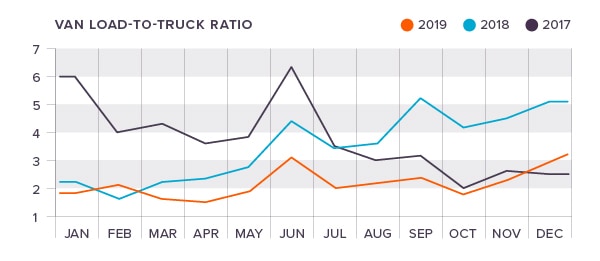

DAT trendlines show surging loads in December

While initial DAT Van-to-Truckload rates followed trends from the previous year (decreasing in October to 1.69 before increasing in November to 2.26 loads per truck), the rates took a sharp increase in December, a break from the noted decrease in 2018. Van-to-truckload rates ended 2019 at a high of 3.3, the highest they have been in 16 months. This is likely due to the holiday shipping rush combined with the closure of many notable carriers across the nation. The effects of these closures are being felt in posted rates, and DAT has noted that further constraints in the availability of trucks will continue to be felt throughout 2020. This could mean an increase in carrier rates and truckload prices.

The national freight rates ended December at:

- Van: $1.94

- Flatbed: $2.17

- Reefer: $2.30

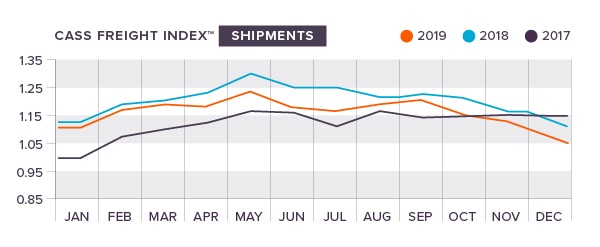

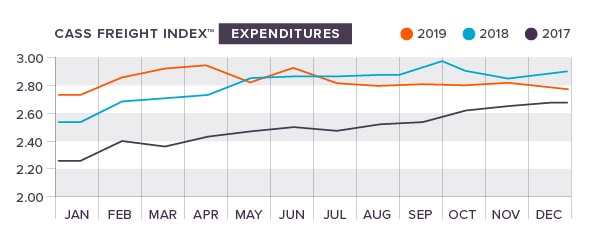

The Cass Indices show the sharpest decline in a decade

Shipments dropped sharply in Q4, according to the Cass Indices. While this follows a familiar pattern that has been set in years past, this quarter’s decrease marks a much sharper downfall than we have seen in the past four years. December’s shipment numbers were particularly low (1.05), dropping to a lower mark than any other December in the past four years. This was the lowest decline we have seen since the Great Recession of 2008.

Expenditures also fell in December of Q4, but not as sharply as shipments. The numbers still maintained a YOY increase from 2016 and 2017 but trailed behind 2018’s numbers.

Cass Information Systems, Inc., points to Christmas and New Year’s Day falling on Wednesdays as the reason for the particularity soft end of the year.

Tonnage index continues to fall

The American Trucking Associations’ (ATA) seasonally adjusted tonnage index took a tumble in Q4, dropping by 0.3% in October and plunging downward by 3.5% in December. The sharp decline in December caps off a 7.2% decrease since July of 2019, and it was the first month of the year to see a YOY decrease from 2018. The ATA attributed the drop in Q4 to a decrease in manufacturing activity along with more moderate economic growth. Despite the declines, the index is still up by a total of 3.3% over 2018, marking some growth in the industry over the course of the year.

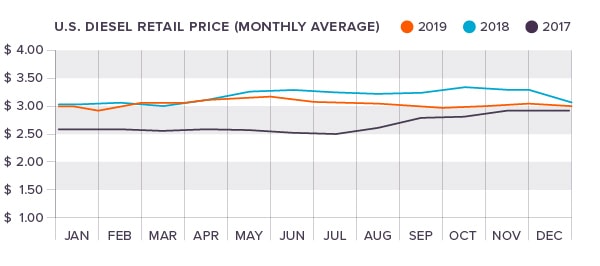

Diesel fuel prices fuel concerns over shipping prices

After ending Q3 at a near year-long low for the year ($2.976 per gallon), diesel fuel prices rose for three consecutive months at the end of the year. Fuel prices began each month at $3.047 in October, $3.062 in November and $3.070 in December. It’s expected that these prices will continue to rise throughout January (they began the year at $3.079) and possibly throughout the entirety of Q1.

Planning ahead for 2020

Based on the projections from our report, 2020 will shape up to be a rather unpredictable year, but you can mitigate the uncertainty of fuel prices, trucking rates and everything else that will come by partnering with a trusted 3rd-party logistics provider. We stay on top of industry happenings and can help you plan and execute a logistics plan that works for your business. Ready to talk solutions? Contact our team today.

Joel Rice

Joel Rice