Now that we’re well into 2019, it’s time to see what’s happening in the logistics industry. Q1 is always important because it sets the pace for the entire year. So far, economic growth has eased after strong growth in 2018. Average GDP growth for 2018 was 3% and experts are predicting that 2019 growth will average about 2.5%. This growth, combined with a rebounding consumer confidence and stock market coming off the recent government shutdown, are presenting a sunny outlook for the logistics industry as a whole.

Let’s take a look at some of the other most recent trends and statistics.

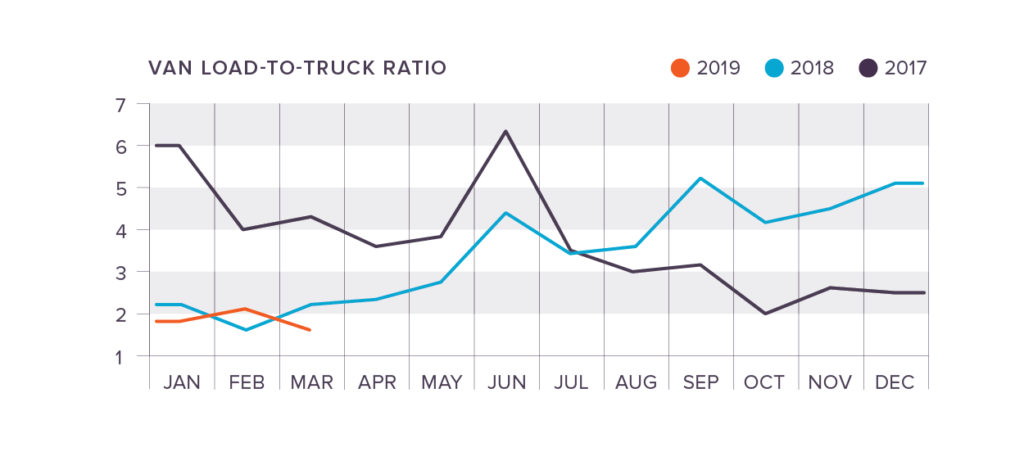

DAT trendlines are good news for bottom lines

Q1 DAT trendlines, which describe the balance between freight availability and truckload capacity on the spot market, hovered between 1.5 and 2.0 across all months. The ratio reached a high point in February (2.0) before dropping to 1.72 by the end of March. These ratios are significantly lower than the 2018 numbers which saw highs of 6.0 in January before falling to just above 4.0 in March — this is great news for shippers. Freight rates are not expected to rise until the van-to-truckload ratio hits the 2.5 to 3.0 range.

Note: As of March, 2019, DAT changed the way they measure their Van to Truckload Ratios. From their website: “Previously, the ratios in Trendlines referred to long-haul lanes only, while the products reported ratios for all outbound loads and trucks posted in the selected location. Once DAT introduced the Hot Market Maps, however, it made more sense to have the Trendlines report include all the load and truck posts, not just the ones for long-haul lanes, so Trendlines visitors would have an experience that matched the product more closely. The ratio trends didn’t change very much, but the numbers are different.”

Overall, DAT describes the truckload spot market as “quiet.” Van freight volumes did increase more than 6 percent at the end of March but there was plenty of capacity to cover the increase in demand. Rates remained flat because of this. These low numbers were also the result of severe weather that struck the Midwest at the end of March, leading to historic flooding and the closure of several key routes (I-80, I-25, I-70 and I-76). The highways have reopened but it will take some time before freight rates begin to creep back up. DAT is expecting the “Spring Surge” rise in rates to be put off for at least a few more weeks.

The national freight rates ended March at:

- Van: $1.87/mile

- Reefer: $2.19/mile

- Flatbed: $2.34/mile

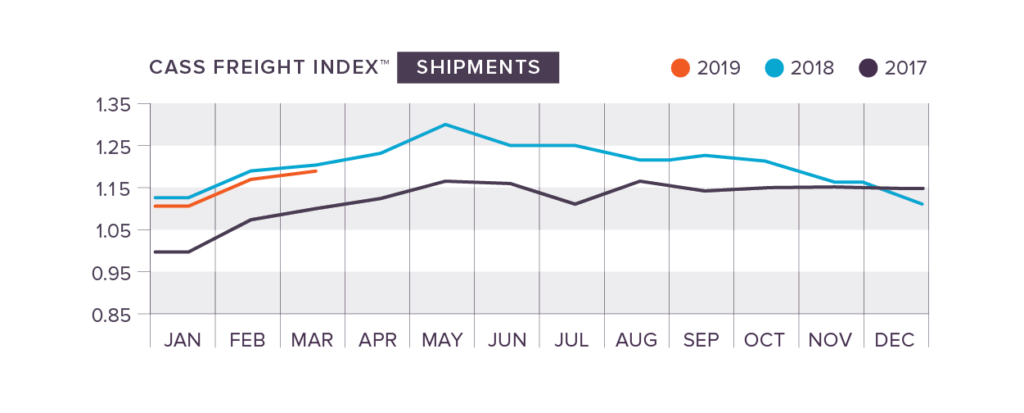

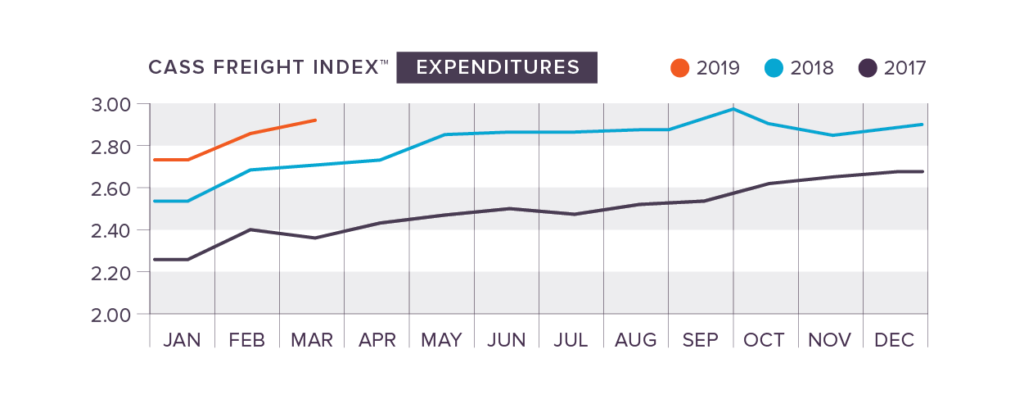

More shipments are on the horizon

After dropping from December to January, both Cass Indexes saw major improvements in February. Shipments were up to 1.173 and expenditures rose to 2.874 by the beginning of March. While the increases are welcome news, shipments are still trailing the 2018 numbers by -2.1% compared to last year. At the same time, expenditures are up by 5.5%. The latest Cass report states that though the organization is cautious with these numbers, it doesn’t believe there is any cause for concern at this time.

Tonnage Index surges to start the year

The Tonnage Index increased by a total of 6.6% from January to December of 2018 and growth showed no signs of stopping at the start of 2019. The index surged by 2.3% in January, 5.5% higher than the January 2018 increase. Although there was a very small (.2%) decrease in February, the American Trucking Association is expecting moderate increases throughout the year.

No news is good news for diesel fuel prices

After starting to decline in Q4 of 2018, diesel fuel prices held steady at around $3.00 a gallon in Q1 of this year. A slight downward trend in pricing through February saw prices hit a low of $2.966 per gallon before inching up above $3.00 by the end of March. These numbers are comparable to Q1 of last year. As of now, there are no big changes in pricing but if trends follow previous years, prices will begin to climb come May.

After millions of miles, we’re celebrating a big milestone

On a more personal note, King Solutions is celebrating its 30th anniversary this year! We are blessed to have built such an incredible foundation in this industry.

In 1989, King was established as a values-based 3PL company with a commitment to a customer-focused approach. Thirty years later, we still continue to do great work for great people. If you take a look back at our Q4 report, you can easily tell that 2018 was an incredible year for King Solutions and our clients. Not only did we open a new facility in Chicago, we also expanded our Minneapolis-based facility to incorporate temperature-controlled warehousing space. These expansions will play a major role in our focus for 2019, opening the door for many new possibilities for our clients. Get in touch with a King representative to talk about all the new solutions now available to you.