Summer is here, which tends to bring increases in shipments, diesel fuel prices, and other challenges for the logistics industry. This is the first summer season since the global COVID-19 pandemic, so logistics experts are eager to see how the numbers pan out in regards to the recovery of the economy and of supply chains across all sectors.

Before we dive into the Q2 numbers, take a look at how the year started off by reading our Q1 report.

Q2 economic outlook

The latest economic forecasts predict that GDP growth will rise to 9% in Q2. This is following the strong economic growth we saw in Q1 as the pandemic recovery continues across the nation. The economy is now open, and many businesses along with most states have lifted their restrictions on masks, customer limits, and many other pandemic regulations. We can expect to see a large wave of consumer spending across many struggling sectors as we continue into the summer months and push further into Q3.

Spot Rates dip in April before soaring into summer

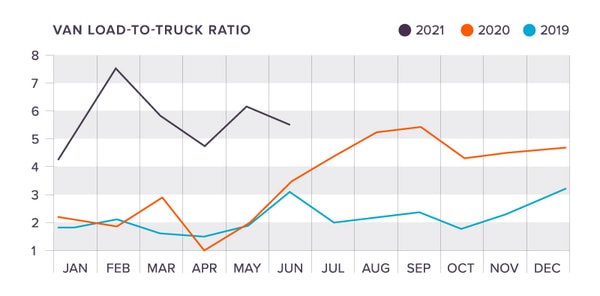

Since COVID-19 hit U.S. shores, and all throughout the past 15 months, the North American truckload market has been operating at near full capacity. Quarantines pulled many carriers off the roads, and even after they returned, high consumer demand for nearly all products has kept capacity at its limit for over a year. We are still seeing those effects more than halfway through 2021, and although carriers are doing an incredible job moving freight, capacity is still constricted across many channels. Because of this, even small changes in either direction can create a ripple effect that causes waves across the industry.

In April, the Van-to-Truckload Ratio dropped to 4.79, almost a low point for the year. This dip didn’t last long as the summer season hit and ratios climbed back up to 6.12 and 5.56 in May and June, respectively. Reefer ratios have seen strong increase over the past two months, which is to be expected as the summer season increases temperatures as well as demand for cold shipping of food.

National Spot Rates at the end of June were:

Van: $2.67

Flatbed: $3.15

Reefer: $3.09

The Cass Indices continue to break records

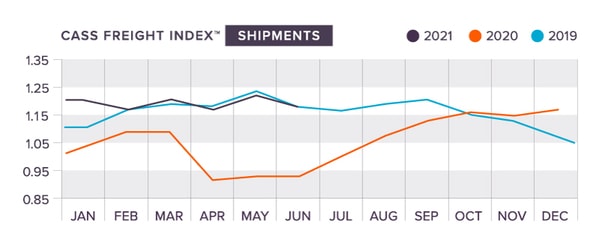

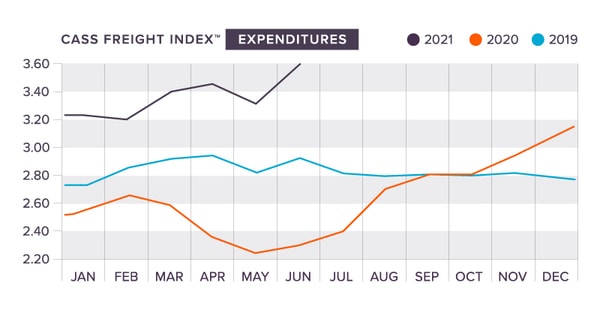

Q2 was a record-breaking quarter for the Cass Shipments and Expenditures Indices, showing strong growth in the industry as a whole. Shipments were up 26.7% year-over-year in April, setting a record, while expenditures were up 45.1%. This marked the fourth time that the expenditures set a record in the past five months.

The increases didn’t stop in May or June. The Shipments Index set another YOY record increase of 35.3%, while the Expenditures Index smashed April’s records by increasing 49.9%. These increases mark a faster recovery from the pandemic than that of the Great Recession, according to Cass Information Systems, Inc.

The Shipments Index and Expenditures Index rounded off the quarter in June with 26.8% and 56.4% (another record) increases, respectively.

The Tonnage Index decreases but remains ahead of 2020

The seasonally adjusted Tonnage Index dropped by 0.6% in April and 0.7% in May. While the numbers were expected to increase in Q2, the drop still keeps the Tonnage Index at higher levels than they were in 2020. April’s index was 6.3% above April 2020 May’s index was 3.7% above 2020. This was the first time the index posted YOY increases over last year, and the decrease were far less than those posted in Q1, showing signs of a recovery that can be expected in the coming months.

The retail, home construction, manufacturing, and fuel delivery sectors led the way in trucking and will be key in the hopeful increases in tonnage in the coming months.

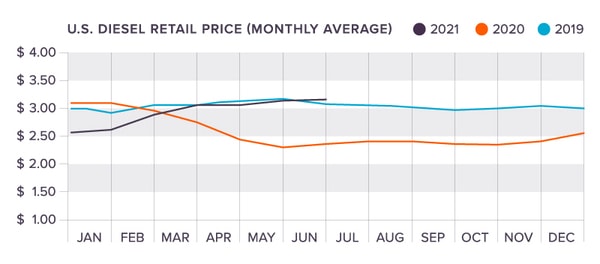

Diesel fuel prices peak in summer

As expected, the summer months have added to the continued climb in diesel fuel prices. Prices climbed a total of 20 cents across Q2, increasing to 3.144 in April, 3.142 in May, and 3.274 in June. This continues a trend of increasing fuel prices throughout the summer, and we can expect these increases to continue in the coming months.

Don’t sweat it with King!

Are rising fuel prices and decreasing capacity putting a strain on your supply chain this summer? Don’t sweat it! King can help you mitigate the effects the summer months have on your supply chain. Get in touch with us to talk about the solutions you need for your business.

Joel Rice

Joel Rice