The start of 2023 has come and gone, and while it was predicted at the end of 2022 that the logistics industry would face some uncertain challenges, we were hopeful. Based on the numbers, there was plenty of room for economic growth and supply chain success.

Now that we’ve reached the start of Q2, we can say that the industry is holding strong, but the outlook for the rest of the year remains uncertain at best. Economic struggles may lie ahead, but there’s some good things coming out of the latest data.

Catch Up on the End of 2022

Want to see how 2022 ended? See the data from our Q4 report.

Expected GDP Growth Warns of Challenging Times Ahead

Talk of recession in 2022 was squashed late in the year as the economy held strong in Q3 and Q4, with the GDP expanding rapidly throughout the holiday season. High exports and consumer spending, combined with increased government spending, have also led to inflation in the economy.

These trends are not expected to continue in 2023.

Experts are currently predicting about a 1% GDP growth in Q1, and their forecast for the remainder of the year unfortunately remains grim. Rising interest rates, continued concerns over inflation, slowing production and imports, and the recent collapse of Silicon Valley Bank are paving the way for concerns of another recession.

Experts are predicting up to three consecutive quarters of GDP contraction starting in Q2 of 2023.

Consumer Confidence, Employment, and Manufacturing Output are Level

After finishing 2022 strong with a sharp increase in December (coming in at 101.4), the U.S. Consumer Confidence Index® continues to rise throughout Q1, with notable increases in February (to 103.4) and March (to 104.2). Rising consumer confidence provides a hopeful outlook, but the index still lags the prior year. Surveys show that consumers are confident about what’s ahead but less optimistic about the current market.

The March employment situation experienced little changed in terms supply chain jobs. While 236,000 nonfarm payroll jobs were added, the majority were in leisure and hospitality, government, professional and business services, and health care. The unemployment rate was changed slightly at 3.5 percent. Transportation and warehousing saw an increase in 10,000 jobs, retail trade lost 15,000 jobs, and manufacturing jobs were largely unchanged.

After small increases at the end of 2022, U.S manufacturing output continued to remain low. A small increase occurred in January (0.8 percent), followed by a slight decrease (0.2 percent) in February. Output is still low, and supply chains aren’t being helped by a low number of imports either.

Capacity and Spot Rates Follow Yearly Trends

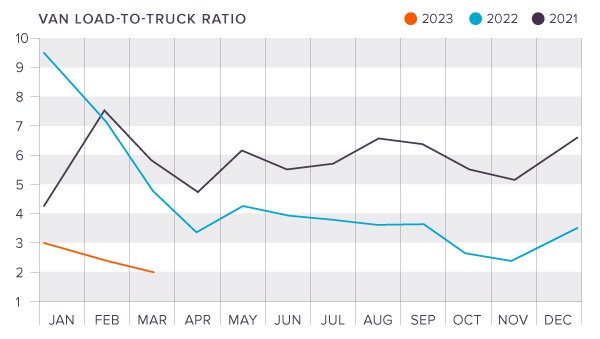

The DAT National Van Load-to-Truck Ratio followed suit when compared to prior years, continuously dipping throughout Q1. If the trends continue, we can expect the ratio to recover at the start of Q2 and rise through May.

The ratio started the year at 3.01 (compared to 9.34 in 2022 and 4.27 in 2021), indicating that capacity is in a good position right now. The ratio dropped to 2.52 in February and even further to 2.05 in March. The ratio continues to be significantly lower than in prior years. Capacity looks good for shippers right now, but this tends to change as we hit the spring and summer months.

National Spot Rates at the end of March were:

- Van: $2.11 (Spot) and $2.76 (Contract)

- Flatbed: $2.70 (Spot) and $3.34 (Contract)

- Reefer: $2.46 (Spot) and $3.01 (Contract)

Cass Freight and Shipments Struggle, but Remain Stable

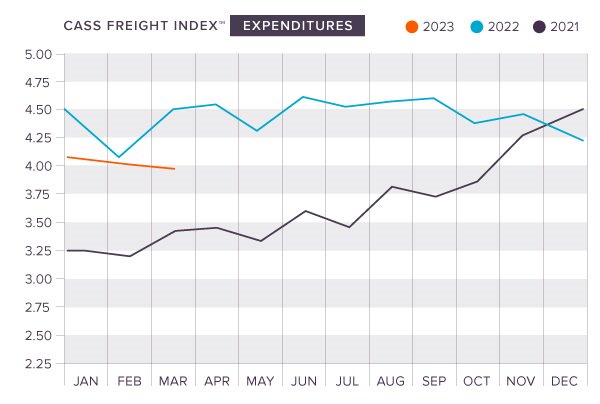

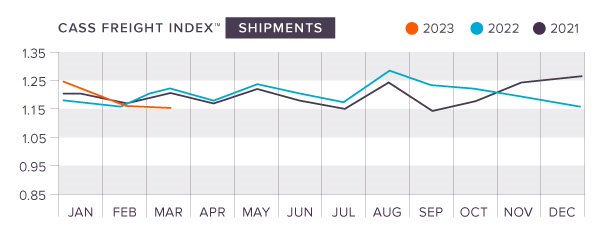

The Cass Shipments and Freight Expenditures Indexes hit a rough patch at the start of the year, with both shipments and expenditures dropping by 3.2 m/m percent in January. Seasonally adjusted (SA), the indexes were essentially unchanged, and the y/y change remained positive (+4.3 percent). Despite the drop, the shipments index performed better than expected, with several factors contributing to the performance:

- Improved auto production

- Mild weather across much of the country

- A fall in import volumes

- Overstocked inventories due to a soft holiday season

There has also been a noticeable increase in truckload (TL) freight, indicating that freight is moving from other modes, particularly LTL and intermodal.

In February, the shipments index sharply increased by 3.8 percent m/m, with an SA change of -0.3 percent. Soft retail sales and destocking issues remain the primary challenges, and decreased imports indicate they will not let up soon, but the index has shown remarkable stability since October of 2022.

The February expenditures index did not fare as well, dropping 1.9 percent m/m and adding some volatility in the freight marketplace. Capacity remains an issue, but not in the normal sense; there are too many drivers available when compared to the amount of freight on the market. This is good news for shippers, as prices are stable, but bad news for carriers who are currently in a competitive marketplace when it comes to securing loads.

Tonnage Index Recovers

The American Trucking Associations’ (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index saw sizable increases at the start of the year—increasing 0.6 percent in January and 1.2 percent in February. This came after experiencing the largest decrease in November (dropping 2.5 percent) since the start of the COVID-19 pandemic. The total increase in tonnage since that drop has totaled 2.9 percent, an ideal recovery for the index.

The ATA attributes these increases to capacity from carriers who “primarily operate in the spot market and/or bought expensive used equipment in the last couple of years.” More freight has been shifted to contract carriers of late, who make up a majority of the index. Higher demand has pushed the index higher, but it has yet to reach the recent high that hit in September of 2022.

The January 2023 Tonnage Index (117.1) was up 1.5 percent over the same month last year. As we look ahead, it’s hard to predict further increases or decreases in the index. Heightened summer infrastructure spending can boost freight volumes, but slowed factory output and home construction will continue to be a hurdle for the recovery of recent freight softness.

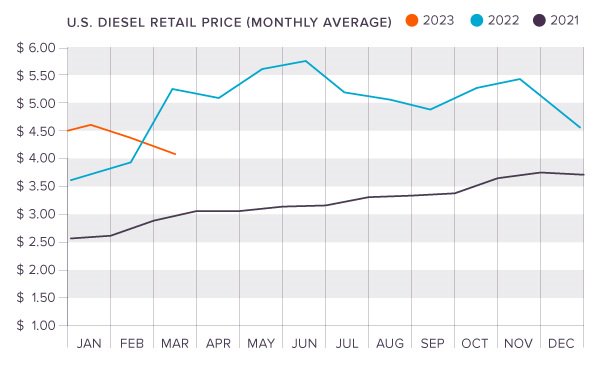

More Relief on Diesel Fuel Prices

Diesel fuel prices continued their downward trend, reaching $4.128 a gallon by late March, the lowest they’ve been since February of 2022. Now midway through April, we can confirm that prices continue to drop. This decrease is 9 percent over Q4, 2022, and a decrease of over 20 percent from the same time last year.

Diesel fuel prices only fluctuated in January, slightly creeping upward to $4.622 before resuming downward, which the entire industry is relieved to see.

As of the writing of this report, diesel fuel prices were resting at a national level of $4.098 per gallon.

Prepare for Peak Season with King

It’s only April, but August is just a few months away. The summer moves quickly, so now is the time to start planning for peak shipping season. At King Solutions, we help our clients prepare fully customized shipping plans that help their supply chains perform at their best, while being prepared for the worst.

From shipping to storage, and everything in between, we bring optimization to supply chains to help our clients achieve sustainable growth. Ready to take the first step? Get in touch with us today to talk about the solutions your business needs.

Joel Rice

Joel Rice