We have reached the end of 2022 at last. It was a transformational year for the logistics industry. Key links in domestic and global supply chains have had to adapt to the challenges brought by disruptions, potential recessions, and many other changes in the global landscape.

What’s the prognosis for how 2022 concluded? By reading this report, you’ll see that it wasn’t all bad news. There are some challenges ahead, but the numbers leave plenty of room for growth as we push farther into 2023.

Catch up on the Q3 logistics industry numbers

Last quarter, the economy was teetering on the edge of an official recession, but the numbers leading into the holiday season were promising. Diesel fuel prices were dropping, consumer confidence was up, and a few other key metrics were continuing to improve.

Need to play catch up? See the data from our Q3 report.

GDP growth recovers after talks of a recession

The big conversation last quarter was whether to classify the two consecutive quarters of negative GDP growth as a recession. That argument has been put to rest as GDP expanded rapidly in Q3 by 3.2 percent, showing strong growth heading into the holiday season. This large increase is thanks to increases in exports and consumer spending, as well as heavy spending from federal and state and local governments. The leaders in exports were industrial supplies and materials (notably nondurable goods), and consumer spending was led by health care and “other” services.

Experts predict smaller, but still positive GDP growth in Q4, with increases in labor force participation and decreases in inflation rates contributing to renewed growth.

Consumer confidence bounces back to end the year

After consecutive declines in the months of October and November, the Consumer Confidence Index® increased in December to 108.3, a sharp increase over the 101.4 number. 2022 ended with the confidence index at its highest level since April, leaving us with hopes of stronger consumer spending heading into 2023. The large increase was attributed to confidence in the economy and jobs, decreasing gas prices, and a lower rate of inflation.

The employment situation in December also saw some good news—with about 223,000 nonfarm payroll jobs being added and the unemployment rate dropping to 3.5 percent. Notable job gains were had in leisure and hospitality, health care, construction, and social assistance. There were small gains in manufacturing (+8,000) and transportation and warehousing (+5,000). The labor force participation rate was relatively flat at 62.3 percent.

U.S manufacturing output limped along at its lowest rate increase of the year, increasing by just 0.6 percent going into Q4, 2022. In all, the economy had a lackluster end of the year, but rising consumer confidence, GDP growth, and slowing increases in inflation are good news heading further into 2023.

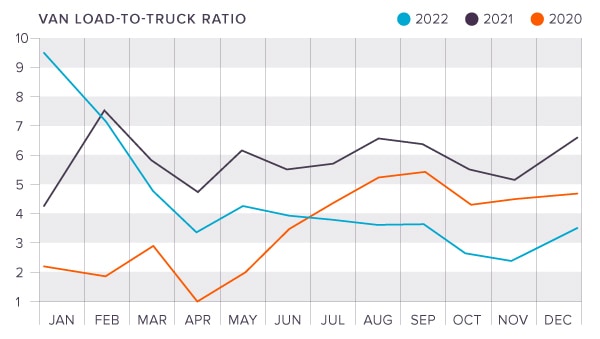

Spot rates follow seasonal trends, lag behind last year

National spot rates followed the same trends as prior years, dipping in October and November before starting their rise in December. According to the DAT TrendlinesTM, the Van-to-Truckload Ratio dropped to the two lowest points of the year (2.92 in October and 2.68 in November) before recovering to 3.45 in December. These drops and increases follow the same pattern as 2021, but the numbers lag by -47.3 percent over the prior year.

National Spot Rates at the end of December were:

Van: $2.41

Flatbed: $2.79

Reefer: $2.94

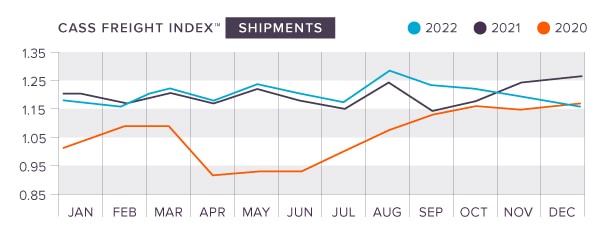

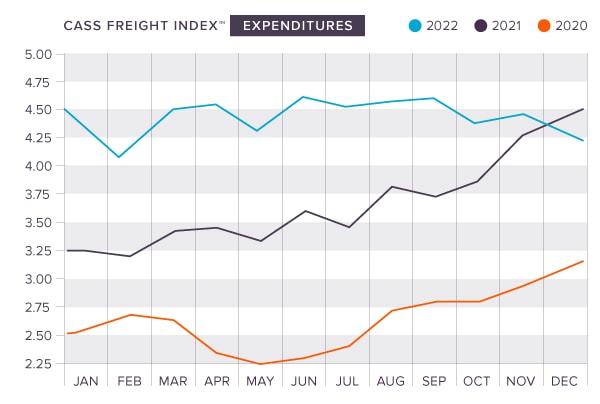

Shipments and freight expenditures fell throughout the holiday season

The Cass Shipments and Freight Expenditures Indexes continuously dropped throughout the holiday season and Q4, with some seasonality pushing the numbers into positive territory. In October, the Shipments Index fell 1.4 percent m/m, most likely caused by a mixture of inflation and stock buildup for the holiday shopping season. Freight Expenditures also fell 4.9 percent in October, indicating a decrease in freight rates for the first month of Q3.

We saw similar drops in shipments in November, with the index falling 1.9 percent m/m. The declines in this normally shipping heavy month were largely due to decreases in imports, particularly on the West Coast. Freight expenditures, however, increased 1.8 percent m/m and 4.7 percent y/y, indicating higher freight rates despite a soft shipping month.

In December, both shipments (-3.3 percent) and expenditures (-5.5 percent) fell sharply, with seasonal adjustments pushing them both into positive gains. Retail sales broadly grew with inflation rates, but the holiday season as a whole was soft. In all, the indexes showed a very flat Q4 for shipping.

As we move into Q1 of 2023, we expect this flatness to continue, but a new year means new trends will be set. Changes in these numbers will largely depend on the economic performance carrying into this year.

Tonnage index tumbles to end the year

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 2.5 percent in November, the second straight decrease in Q4—the index also dropped by 1.2 percent in October. The November decrease was the single largest drop since the start of the COVID-19 pandemic, bringing the Tonnage Index to a total of 114.7 by the end of the month.

These dips in tonnage demonstrate a soft freight season in the fall, the result of a slowing goods economy. While the numbers are low month-over-month, they are still higher than the 2021 data of the same months, keeping alive a 15-year year-over-year increase.

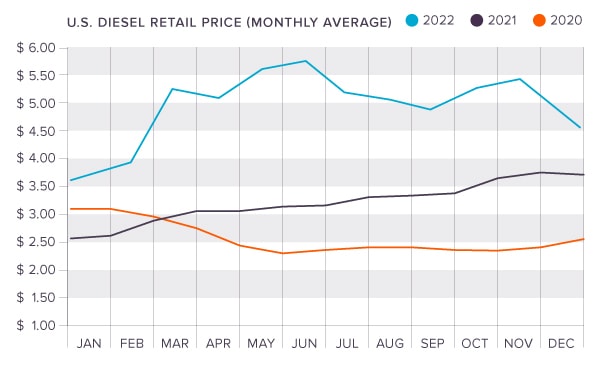

Diesel fuel prices sent us on a roller coaster ride

The price of diesel fuel was one of the largest stories coming out of Q3, with prices falling to their lowest point since February of 2022. But the good news was short lived as we pushed into Q4, with prices eventually climbing back to a high point of $5.333 per gallon in November. This moved the price of diesel fuel to its 13th highest week of prices for the year. Come December, prices did begin to stabilize and drop once again, and they have continued to do so moving into the first few weeks of January.

As of this report, diesel fuel prices are now hovering around $4.604 per gallon.

Start your year right with King

Everyone in the logistics industry can do their best to follow the numbers, but the only certainty in logistics is uncertainty. We can never perfectly predict where the market will go, what global and regional events will impact supply chains, and how each year will play out.

What you can do is hedge your bets and make sure your supply chain is optimized and ready for any unexpected disruptions. At King, we help our customers plan for the best, but prepare for the worst. We make sure your supply chain is fit and ready for anything.

Ready to finally achieve a fortified, optimized, and sustainable supply chain in 2023? Let’s talk about the solutions that are right for your business.

Joel Rice

Joel Rice