2022 has been a tumultuous year for the logistics industry, presenting significant challenges for all facets of the supply chain. Closures in Chinese manufacturing plants, persistently high diesel fuel prices, and a lackluster economy are just some of the issues businesses and shippers have had to combat since January. While the numbers coming out of the industry’s data aggregators may not show significant signs of relief, the logistics industry keeps on moving.

It’s time to take a look at how the logistics industry is fairing in 2022.

Catch up on the Q1 logistics industry numbers

The beginning of the year was a rough start for the economy, but the data showed some promising signs for the logistics industry. See how the year started off by reading our last Extra Mile Report.

Will we hit a recession? The latest numbers say maybe

After experiencing negative GDP growth (-1.6%) in Q1—the first time since Q2 2020—economists began speculating of a potential recession. As we noted in our last report, the logistics industry data was telling a far different story than the reports of negative GDP growth and economic recessions. Since then, economists have shifted their talking points and are now predicting Real GDP growth of 0.8% in Q2. The potential for a recession in 2022 is uncertain as of today.

While this is great news, economists still remain wary of the future. Inflation rates are above 8.0%, and economists are predicting another round of negative growth later in the year; the conversation has shifted from recession to potential stagflation of the economy. The Federal Reserve, in an effort to stave off rising inflation, has increased interest rates by 0.75% and are in talks to raise rates again before the end of the year. While this has been shown to combat inflation, it comes at a price. Rising interest rates are often tied to decreases in consumer spending and drops in stock prices, which are always felt by the logistics industry as spending slows and shipments decrease.

Consumer spending and confidence are on shaky ground

In terms of consumer spending for Q2 2022, results are mixed. While average hourly earnings are up by 6.5%, the consumer price index also rose by 8.2%. People are making more, but the costs of goods have outpaced those earnings. While some economists are predicting that spending will remain the same or even increase in the coming months, the Consumer Confidence Index® is in decline. Whether or not consumers will maintain their spending habits or put money away for the future is yet to be determined.

Employment and manufacturing experience slight growth

The latest June 2022 jobs report showed that some signs of life are returning to the workforce. 372,000 non-farm payroll jobs were added to the workforce in June, keeping the unemployment rate at 3.6% and the labor force participation rate at 62.2%. 36,000 jobs were added in transportation and warehousing, and manufacturing added 29,000 positions, showing good signs of growth across the supply chain.

Stagnant spending and consumer confidence also had an impact on manufacturing output. Although the numbers are in the positive, growth was small. The latest S&P Global US Manufacturing PMI (Purchasers Manufacturing Index) increased to 52.7 in June, the slowest growth in factory activity since July of 2020. New orders were down, but this allowed for manufacturers to clear a backlog of orders that have been clogging supply chains for months.

In all, it was a lackluster quarter for the economy, but the economy was able to hold off further increases in inflation and a recession that could have had far-reaching impacts on the global economy.

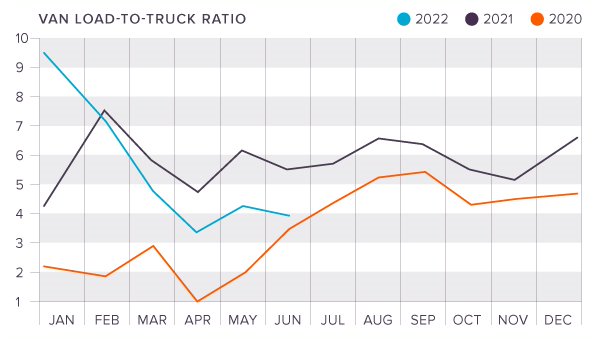

Spot rates continue to decline

Spot rates continued to decline across the board in Q2, after starting at an all-time high in January. The DAT Van-to-Truck Ratio dropped in April, recovered a bit in May, and dropped again in June, settling at 3.88, the second lowest the ratio has been all year. These decreases are typical at this point in the year, with freight movement in a seasonal lull, but diesel fuel prices are also putting pressure on trucking companies and shipping rates.

National Spot Rates at the end of June were:

- Van: $2.73

- Flatbed: $3.55

- Reefer: $3.12

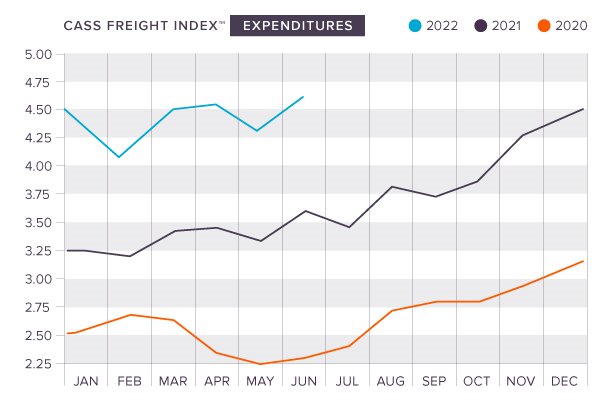

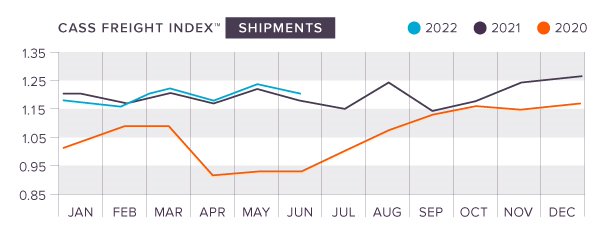

Cass Indices stabilize after a sudden drop

Inflation, interest rate increases, and global instability that includes war and lockdowns in China are also having an impact on freight shipments and expenditures across the industry. U.S. freight volumes fell 2.6% in March after surging for nearly two years. The Cass Freight Index recovered in May, increasing by 5.4%, which assuaged concerns over the potential of a freight recession. Cass Information Systems, Inc. is now predicting stability in the industry as news from the retail sector and in the oil markets remains positive for the coming months.

The Cass Expenditures Index (seasonally adjusted) fell 2.0% in April and 5.9% m/m in May, with more LTL and less TL in the data, showing that shippers are largely focusing on the often more cost effective LTL shipping methods to consolidate their loads.

Although Cass Information Systems, Inc. normally compares their data to the numbers two years ago, comparisons to 2020 will have little meaning due to the impacts of COVID-19, so Y/Y comparisons are not being taken into account for the purposes of this report.

Tonnage Index falls back but recovers in Q2

After increasing by 1.8% in March, the eighth straight gain in 2022, the seasonally adjusted Tonnage Index fell by 1.4% in April, indicating a shift from spot market loads to contract freight. ATA (American Trucking Associations) Chief Economist, Bob Costello noted that “the market is transitioning back to pre-pandemic shares of contract versus spot market.”

The index recovered in May, increasing by 0.5%, the second highest level since the pandemic started, but slowing retail sales, manufacturing output, and other economic indicators are still holding the index back from high levels of growth.

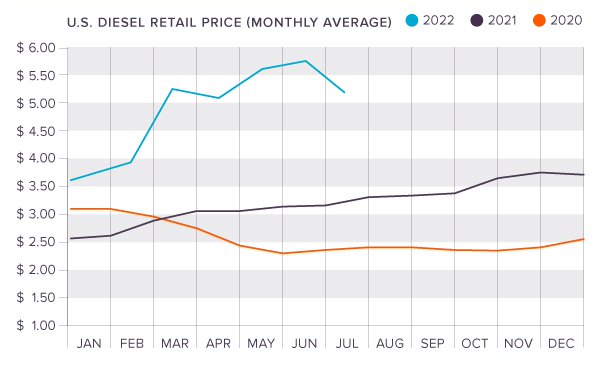

Diesel fuel prices climb again

After temporary relief in April, where diesel fuel prices declined slightly, the cost of fuel began another surge that has continued to hike prices across the industry. The price of diesel fuel began Q2 at 5.144 in April and ended at 5.783 at the end of June. Prices have begun to drop early in July, but there is little indication that drastic fuel price relief is on the way in the near future. The most hopeful news is that the price of regular gasoline has continued to fall, the longest streak of decreases the nation has seen since the start of the pandemic in 2020.

Find relief with King

As we noted in this edition of the Extra Mile, more shippers are turning to LTL shipping to save on the costs of shipping. At King Solutions, we specialize in load consolidation and LTL shipping optimization, helping our clients move their freight more efficiently and reliably. Looking to optimize your shipping operations with LTL and PTL shipping? Get in touch with us today to start planning your consolidation efforts.

Joel Rice

Joel Rice