2022 is here, and so are the latest numbers from throughout the logistics industry. 2021 was expected to be a year or rebound and growth. While we experienced both throughout the year, the unexpected persistence of COVID-19 and its variants, along with labor shortages, tightening capacity, and other supply chain and economic maladies, have stymied the recovery. Still, there are some good signs in the numbers as we head into 2022. The economic number may not be what we want, but we still see some hopeful trends in the data that could forecast a strong year for the logistics industry as well as the economy as a whole.

Let’s get into the numbers!

Need to catch up? Read our reports from earlier in the year

The Q4 economic outlook

After a lackluster performance in Q2, the economy continued to slow in Q3, declining sharply by 2.1 percent in the July to September quarter. Rising inflation and a surge in new COVID cases have been keeping consumers and workers at home, pushing down GDP and further straining what is already a stretched economy. Despite poor numbers throughout 2021, some economists are forecasting huge gains in the economy for Q4, with expectations as high as 8.0 percent GDP growth. It’s too soon to tell, as the data has yet to be released, but these forecasts may be misguided as the Omicron COVID variant has spread far more rapidly than many had expected in Q4.

Hiring also slowed in December as employers struggled to find workers to fill the myriad of open jobs throughout the country. The U.S. economy added 199,000 jobs in December, falling short of the 249,000 jobs added in November. These gains were the smallest in a year and do not reflect the unemployment rate, which fell from 4.2 to 3.9 percent. Small job gains combined with a decrease in the unemployment rate points to people dropping out of the workforce rather than finding employment.

Consumer spending towards the end of the year showed some improvement, increasing by 1.4 percent in October and 0.6 percent in December. These final months mark an expected 8.1% increases year-over-year consumer spending, a strong rebound after the number contracted by 3.8 percent the previous year. If consumer spending continues to rise in the coming months, there is hope for a new growing economy in 2022.

Spot Rates climb through the holidays

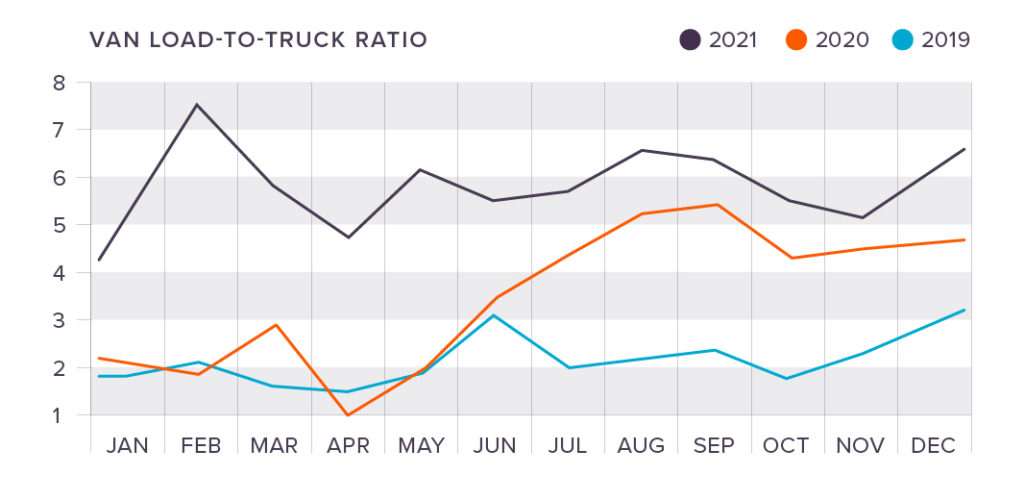

Truckload Spot Rates continued to climb in Q4, driven by increased demand and continued supply chain and labor disruptions. The DAT Trendlines showed noticeable increases in pricing (Van rates went up $0.18 from September to December). The only market that remained relatively unaffected was Flatbeds, which remained stable throughout the entirety of Q4.

Rate increases were primarily driven by congested ports, warehouses, and intermodal yards, as supply chains across the country continued to try and make up lost ground while facing increased consumer demand during the holidays.

National Spot Rates at the end of December were:

Van: $3.00

Flatbed: $3.07

Reefer: $3.47

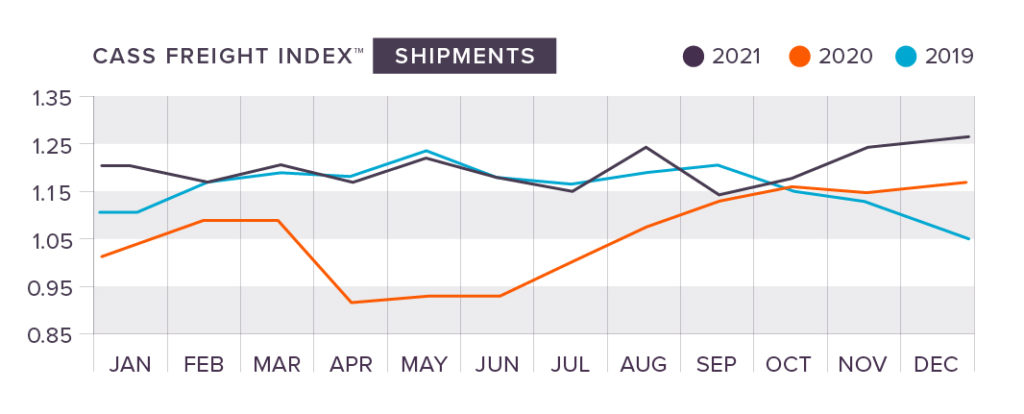

The Cass Indices set new records

The October Cass Shipments Index ticked up in October, increasing 0.8 percent over the same month in 2021. The Shipments Index also surged in November, increasing by 4.5 percent over last year’s November number. Although freight volumes remain capacity-constrained, led by clogs in rail lines and pot congestion, the increase in numbers is a good sign as consumers continue to spend and restocking demands remain high. November also noted a decrease in semiconductor shortages and an increase in automotive volumes. The December index accelerated to 7.7 percent y/y growth despite a record backlog of 105 containerships off Southern California. This strong finish in 2021 is a good sign for the trucking industry and driver/equipment capacity.

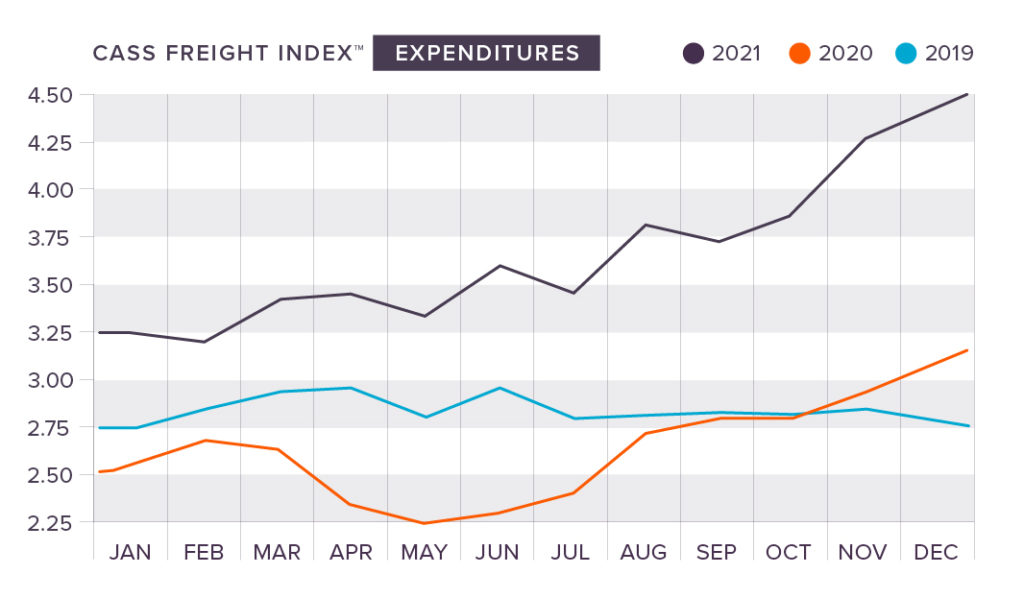

The increased shipments also led to increases in October and November spending. The Cass Expenditures Index increased 37 percent year-over-year in October, reaching a record level of 3.96. And the massive increases didn’t stop there. The new record was broken yet again in November, with the index increasing by 44 percent year-over-year to a new high of 4.275. Expenditures also predictably increased in December, rising again to another record-breaking level f 4.419, a 44 percent y/y increase from 2020.

Gains continue for the Tonnage Index

After slight gains in Q3, the seasonally adjusted tonnage index continued to climb (year-over-year) through the end of the year. Driven by renewed economic growth, the index saw a 0.4 percent increase in October, putting it 1.8 percent over the October 2020 number. In October, the index equaled 113, compared with 112.6 in September.

In November, the Tonnage Index increased 1.3 percent (a 2.5 percent increase over November, 2020), ending up at 114.5. This marked four straight months of increases, totaling 4.3 percent, ending the year strongly. However, there were significant decreases in the months of April through July (totaling 4.6 percent). These recent gains heavily cut into those losses, but more work will have to be done to get the index back to neutral and wipe out the losses incurred earlier in the year.

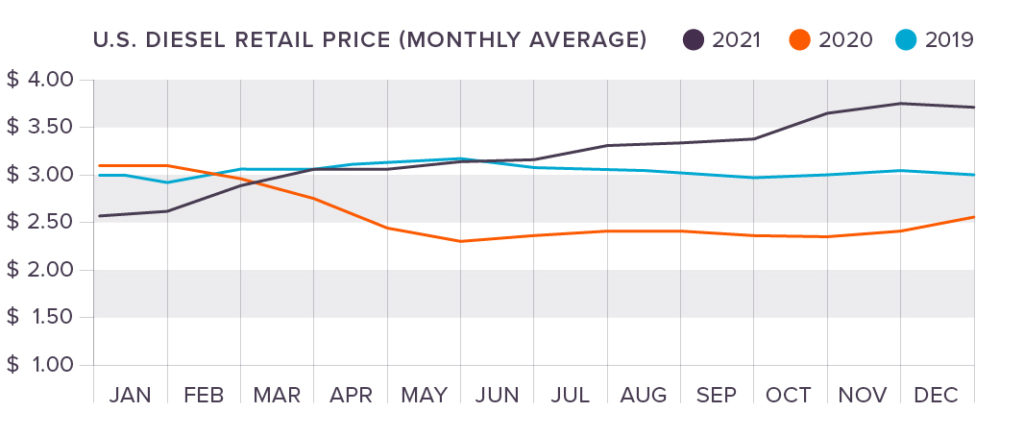

Small Relief for Diesel Fuel Prices

Diesel fuel prices reached record highs in November, hitting the highest point of the year at 3.727 a gallon. That was the 13th straight month of increases dating back to October of 2020. But relief finally hit fuel prices in December. Efforts from the Department of Energy—who in November released over 50 million barrels of oil from the U.S. Strategic Petroleum Reserves—were directly linked to the drop in prices, which continued to decrease in November.

While this relief is very welcome for the industry, shipping should plan ahead for renewed increases in prices. The release of oil from strategic reserves is not a fix for the underlying issues driving up diesel fuel prices. It is instead a temporary remedy that will only last so long as the barrels of oil released are in use in the market. Unless something changes in the global oil market, we can expect to see further increases in diesel fuel prices in the coming months.

Diesel fuel started 2021 off at 2.640 per gallon and ended the year at 3.674 per gallon.

Achieve your goals in 2022?

What are your shipping and logistics goals in 2022? Do you want to grow your operations? Make them more efficient? Better control costs? Increase customer service and support? Whatever you are looking to do in 2022, trust in King to help you achieve your goals. We help clients better manage their supply chains from end to end. It all begins with a conversation regarding your goals for the year. Ready to talk solutions? Get in touch with our team today.

Joel Rice

Joel Rice